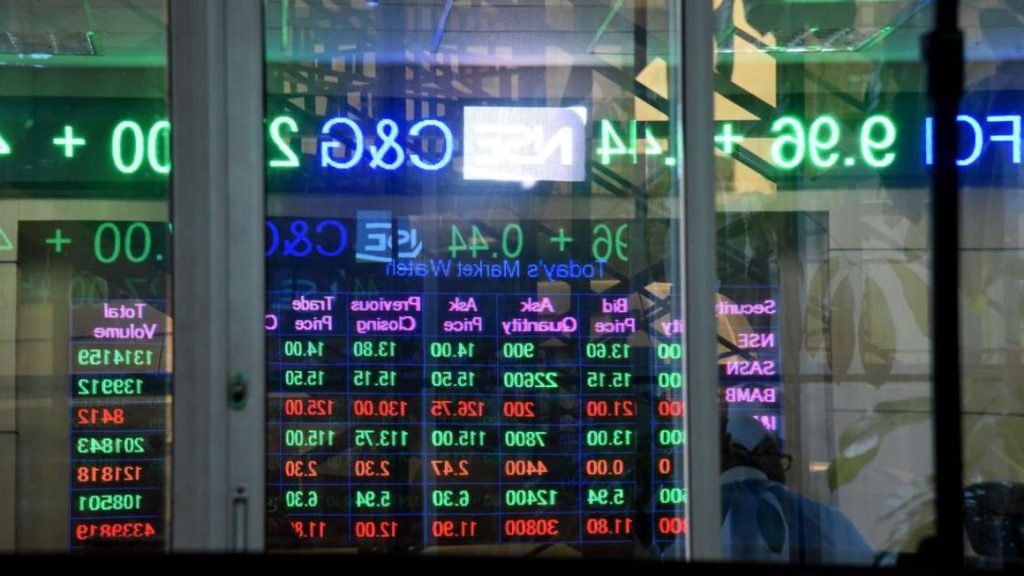

Kenya’s Capital Markets Authority (CMA) has introduced an electronic process for new companies to list on the Nairobi Securities Exchange (NSE). This move aims to cut down the time and costs associated with initial public offerings (IPOs). The shift is part of broader reforms designed to rekindle interest in the stock market, which saw a surge in listings during President Mwai Kibaki’s time in office.

The CMA has implemented stricter rules for electronic IPOs, ensuring fair and equitable allocation of shares to investors while preventing trading malpractices. According to NSE Vice-Chairman Paul Mwai, using electronic methods for IPOs will streamline transactions, reduce costs, and eliminate issues such as the refund process, which has historically been a challenge.

“Electronic IPOs are more efficient. The traditional IPO process can be complex, particularly when it comes to reconciliation and refunds. Automating this process makes it faster and cleaner, which is a welcome change,” Mwai stated. He added that while not all Kenyan investors are tech-savvy, brokers and agents can assist them in navigating the electronic application process.

Electronic IPOs allow companies to offer their shares through the Internet or other digital means, enabling investors to apply for shares electronically. The entire process, from application to allocation, can be managed online. In 2022, Uganda became the first country in East Africa to hold an electronic IPO when Airtel Uganda offered shares to the public. This made it easier for foreign investors, including those from other East African countries, to participate.

Kenya previously experimented with electronic elements in the 2008 Safaricom IPO, although only the application process was partially electronic. Now, CMA has announced through a gazette notice that companies offering shares electronically must ensure that all information is disclosed in a form approved by the regulator. The results of the offer must also be published in the same manner as the information memorandum.

“An issuer of securities must establish a fair and equitable allocation policy for public offers and inform investors about the opportunities to invest,” CMA said. Firms must notify both the CMA and the NSE at least 24 hours before the results of the offer are published.

In addition to IPOs, automated processes are becoming more common in major financial transactions, as both companies and investors seek to take advantage of technology for convenience and cost savings. Last year, investors were able to electronically tender their shares to ICEA Lion Asset Management Ltd when the firm acquired 36.58 million shares in the property fund Ilam Fahari I-Reit. This fund was eventually delisted from the NSE’s Main Investment Market after the transaction.

Similarly, investors in East African Breweries Plc had the option to electronically sell their shares to Diageo Plc when 118.3 million shares in the company were offered last year.