Inflation has become a pressing issue for many African nations, significantly impacting economic stability and the well-being of millions. In 2024, many African countries continue to grapple with the rising cost of goods and services, driven by a combination of domestic challenges and global economic pressures. From fluctuating global commodity prices to currency devaluations and political instability, several factors have contributed to the inflationary pressures seen across the continent today.

This article delves into the primary drivers of inflation in Africa, exploring how these factors affect local economies, livelihoods, and overall development.

1. Global Commodity Prices and Supply Chain Disruptions

One of the leading contributors to inflation in Africa is the rising cost of global commodities, especially food and energy. Africa is heavily dependent on imports for many of its basic commodities, making it highly vulnerable to price fluctuations in the global market.

- Food Prices: Africa imports a significant portion of its food supply, including staples such as wheat, rice, and maize. When the prices of these commodities rise globally due to factors such as climate change, droughts, or geopolitical conflicts, African consumers feel the impact almost immediately. The war in Ukraine, for example, severely disrupted the global grain supply, driving up food prices across Africa in 2022 and 2023, and this trend has continued into 2024.

- Energy Prices: Rising global oil prices have also had a direct impact on inflation. Since fuel is a key input for transportation, manufacturing, and electricity generation, any increase in oil prices significantly drives up the cost of goods and services. Many African countries, such as Nigeria, South Africa, and Ghana, have seen rising energy prices contribute to overall inflation.

Furthermore, ongoing supply chain disruptions—exacerbated by the COVID-19 pandemic, regional conflicts, and global shipping delays—have further limited the availability of essential goods, pushing prices higher.

2. Currency Depreciation

Currency depreciation is another critical driver of inflation in Africa. When a country’s currency loses value against major global currencies, such as the US dollar or the euro, the cost of imports rises, leading to inflation.

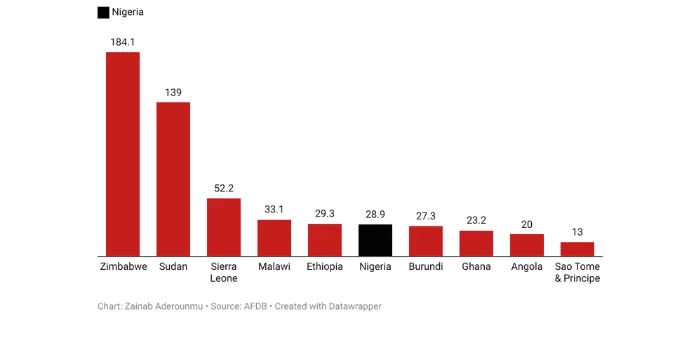

- Weak Local Currencies: In many African nations, local currencies have been devaluing rapidly due to weak economic fundamentals, large current account deficits, and dwindling foreign reserves. Countries like Zimbabwe, Nigeria, and Egypt have faced significant currency depreciation, which has driven up the cost of imported goods, from food to fuel to machinery.

- Debt Burden: Many African nations are grappling with high levels of external debt, which forces governments to devalue their currencies as they attempt to pay off loans denominated in foreign currencies. This, in turn, leads to inflation as local purchasing power declines, making it harder for citizens to afford essential goods and services.

The inability to stabilize currency exchange rates continues to pose a significant challenge to controlling inflation in Africa.

3. Domestic Agricultural Challenges

While Africa is endowed with vast agricultural resources, the agricultural sector faces numerous challenges that contribute to rising food prices, which in turn fuel inflation. Factors such as drought, poor infrastructure, and outdated farming techniques have hindered local food production, forcing many African countries to rely heavily on imports to meet domestic demand.

- Climate Change: Climate change has had a devastating impact on Africa’s agricultural productivity. Prolonged droughts, erratic rainfall patterns, and desertification have reduced crop yields in regions like the Sahel and East Africa. This has led to food shortages and increased prices for staple foods, exacerbating inflation.

- Farmers’ Access to Resources: Small-scale farmers, who make up the majority of Africa’s agricultural workforce, often lack access to modern farming technologies, quality seeds, fertilizers, and irrigation systems. As a result, they struggle to increase productivity, leading to low output and high prices.

- Poor Infrastructure: The lack of efficient transportation infrastructure further complicates food distribution. Many rural areas in Africa have limited access to well-maintained roads, which delays the transportation of agricultural produce to urban markets. These logistical challenges increase the cost of getting food to market, contributing to higher prices for consumers.

4. Political Instability and Conflict

Political instability and ongoing conflicts in several African countries have also played a significant role in driving inflation. Countries affected by internal conflicts often experience economic disruptions, displacement of populations, and destruction of infrastructure, all of which negatively affect production and trade.

- Sudan and South Sudan: In Sudan, the ongoing political crisis has severely disrupted economic activity, causing shortages of essential goods and sharp increases in prices. Similarly, in South Sudan, years of conflict have crippled the economy, leading to hyperinflation as the government struggles to maintain control over the currency and resources.

- Ethiopia’s Tigray Conflict: The conflict in the Tigray region of Ethiopia has led to widespread economic instability, resulting in a sharp rise in food prices and inflation. The disruption of agricultural activities in this region, coupled with the displacement of millions of people, has made it difficult to stabilize the local economy.

- Regional Conflicts in West Africa: In countries like Mali, Burkina Faso, and Niger, where insurgent groups continue to pose security threats, inflation has risen as governments redirect resources to military efforts, leaving less available for economic development and price stabilization.

Political unrest not only undermines investor confidence but also disrupts economic activities, leading to inflationary pressures that are hard to control.

5. Rising Public Debt and Fiscal Deficits

Many African countries are grappling with rising public debt and large fiscal deficits, which have a direct impact on inflation. Governments often resort to borrowing to finance spending, leading to increased money supply without corresponding economic growth.

- Printing Money: In some cases, African governments have resorted to printing money to cover budget shortfalls, which leads to inflation by increasing the amount of money in circulation. This has been particularly problematic in countries like Zimbabwe, where hyperinflation has eroded the value of the local currency and driven up prices.

- Subsidy Reductions: In an effort to reduce fiscal deficits, many African governments have also cut subsidies on essential goods such as fuel, food, and electricity. While these measures are intended to restore fiscal discipline, they often result in immediate price hikes that fuel inflation. For example, the removal of fuel subsidies in Nigeria led to sharp increases in transportation and food costs.

These fiscal pressures, combined with poor economic management in some countries, have contributed to rising inflation rates across the continent.

6. Impact of Climate Change on Inflation

Climate change is becoming an increasingly significant driver of inflation in Africa, particularly in sectors such as agriculture and energy. As weather patterns become more unpredictable, crop yields fluctuate, driving up food prices.

- Drought and Floods: Prolonged droughts in regions such as East Africa and Southern Africa have severely impacted agricultural production, leading to shortages of food and increased prices. Conversely, extreme flooding in other parts of Africa, like West Africa, has destroyed farmlands, further exacerbating the food supply issue.

- Energy Production: Climate change also affects energy production in Africa, where many countries rely on hydropower for electricity. When water levels in dams fall due to droughts, power generation is disrupted, leading to higher energy costs as countries turn to more expensive energy sources such as fossil fuels.

The unpredictability of weather patterns continues to create uncertainty in food and energy prices, making it difficult for African economies to maintain price stability.

7. The Role of International Institutions and Aid

International financial institutions such as the International Monetary Fund (IMF) and the World Bank play a crucial role in shaping the economic policies of African countries, particularly those facing inflationary pressures. These institutions often recommend austerity measures, including subsidy cuts and tax increases, as part of loan agreements.

- Structural Adjustment Programs (SAPs): Historically, structural adjustment programs have been implemented in several African nations to reduce fiscal deficits and stabilize economies. While these programs are designed to reduce long-term inflation, in the short term, they often result in higher prices for essential goods and services as subsidies are removed and taxes are increased.

- Debt Relief Initiatives: In some cases, international organizations have provided debt relief to African nations struggling with inflation and debt. However, these programs are not always sufficient to address the root causes of inflation, particularly in countries with weak economic management and political instability.

The involvement of international institutions in managing African economies underscores the importance of sound fiscal policies and governance in controlling inflation.

Conclusion: Addressing Inflation in Africa

Inflation in Africa is driven by a complex interplay of domestic and global factors, including currency depreciation, political instability, supply chain disruptions, and climate change. Addressing these challenges requires coordinated efforts at both the national and international levels. African governments must adopt sound economic policies, invest in infrastructure, and enhance agricultural productivity to mitigate the impact of inflation on their populations.

International support, in the form of debt relief, aid, and investment, will also be essential in helping African countries stabilize their economies and protect their citizens from the worst effects of inflation.