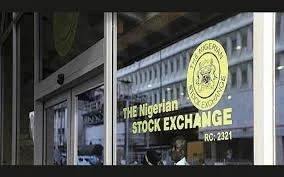

The Nigerian Stock Exchange (NSE) has officially completed its demutualization process after receiving final approval from the Securities and Exchange Commission (SEC). The demutualization marks a significant milestone in Nigeria’s financial market, transforming the NSE from a member-owned institution to a publicly listed company.

The Nigerian Stock Exchange (NSE) has officially completed its demutualization process after receiving final approval from the Securities and Exchange Commission (SEC). The demutualization marks a significant milestone in Nigeria’s financial market, transforming the NSE from a member-owned institution to a publicly listed company.

This landmark approval by the SEC allows the NSE to operate as a profit-making entity. The Exchange will now adopt a corporate structure with shareholders and a board of directors. The process aims to improve governance, transparency, and efficiency in the stock market, making it more competitive and attractive to both domestic and international investors.

The demutualization process was initiated several years ago as part of broader reforms in Nigeria’s financial sector. The goal is to align the operations of the NSE with international best practices. By becoming a publicly listed entity, the NSE is expected to enhance its capacity to raise capital, facilitate the introduction of new products, and expand its services across borders.

Key Details of the Demutualization

The demutualization separates the ownership of the NSE from its management and operations.

The Nigerian Exchange Group (NGX) will be created as the new holding company overseeing the NSE.

The trading and regulatory functions will be managed by the Nigerian Exchange Limited (NGX) and NGX Regulation Limited (NGX REGCO), respectively.

NSE President, Otunba Abimbola Ogunbanjo, expressed optimism that this transition will create a more efficient and sustainable market. According to him, “This is a historic moment for the Nigerian capital market. The transformation of the Exchange is essential to increasing investor confidence and positioning the Nigerian market as a hub for global capital flows.”

The approval also opens the door for the NSE to pursue a potential Initial Public Offering (IPO) in the near future. With the restructuring, the Exchange can sell shares to the public, giving investors an opportunity to own part of the entity.

Market analysts have welcomed the move, highlighting the potential for improved market efficiency and enhanced investor protection. The development comes at a time when Nigeria is seeking to attract more foreign direct investment, particularly as it navigates post-pandemic economic recovery.

The NSE’s demutualization is widely viewed as a crucial step toward modernizing the financial market infrastructure in Nigeria.