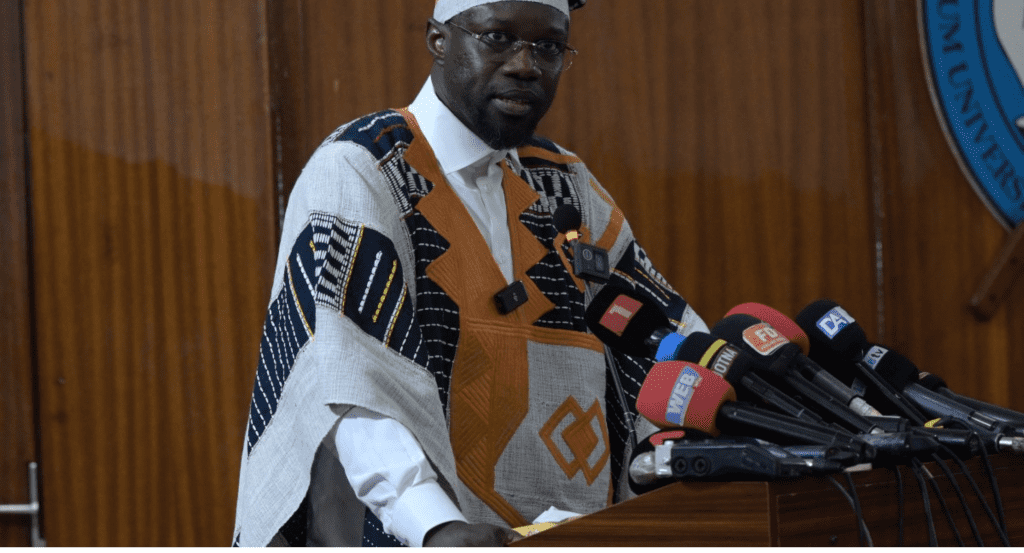

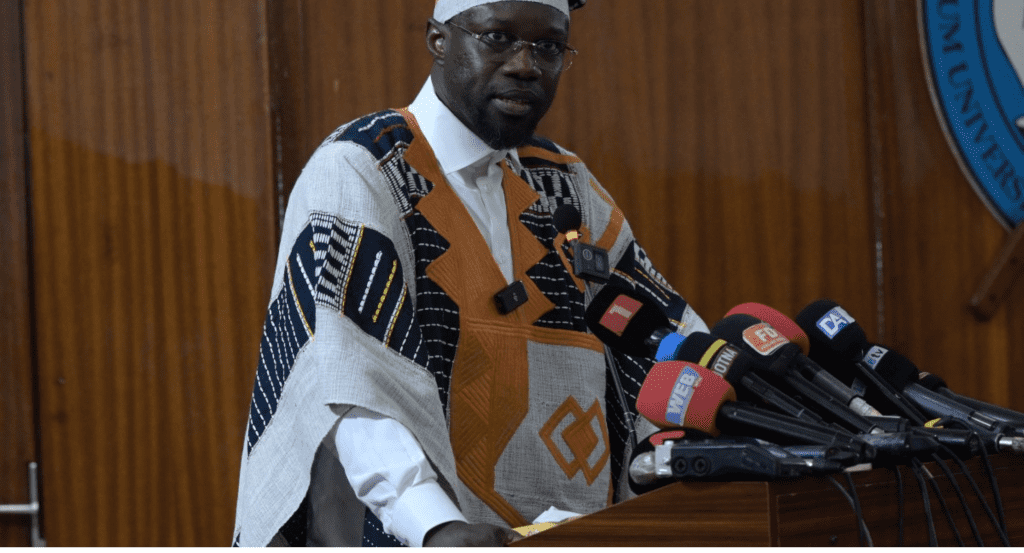

In a bid to strengthen Nigeria’s digital economy, the Central Bank of Nigeria (CBN) today announced a series of new policies targeting digital payments. The initiative, introduced by CBN Governor Godwin Emefiele, aims to deepen financial inclusion and reduce dependency on cash-based transactions. It is expected to positively impact e-commerce, improve financial access, and provide safer transaction methods for millions of Nigerians.

One of the central components of this plan includes enhancements to the existing eNaira digital currency, which was launched in 2021 as Africa’s first Central Bank Digital Currency (CBDC). The eNaira has thus far facilitated over 700,000 transactions valued at about $18.3 million. By streamlining eNaira’s accessibility and integrating it with traditional banking and informal sectors, CBN aims to expand usage among underserved communities. CBN’s vision also involves improvements in user experience to foster adoption among everyday consumers and increase its competitive edge with cryptocurrencies, which remain popular for hedging currency risks.

To further drive digital inclusion, the CBN has also introduced AfriGo, a domestic card scheme aimed at reducing transaction costs linked to foreign card networks and minimizing transaction fees associated with card issuance. The AfriGo card is designed to support financial data control within Nigeria, providing a more secure, cost-effective payment alternative for citizens and bolstering data sovereignty, according to the CBN. This approach aligns with CBN’s Payment Systems Vision 2025, aimed at fostering innovation and achieving a cashless economy by enhancing digital payment adoption in Nigeria.

Through these policies, the CBN seeks to position Nigeria as a leader in Africa’s digital finance sector while enhancing financial resilience.