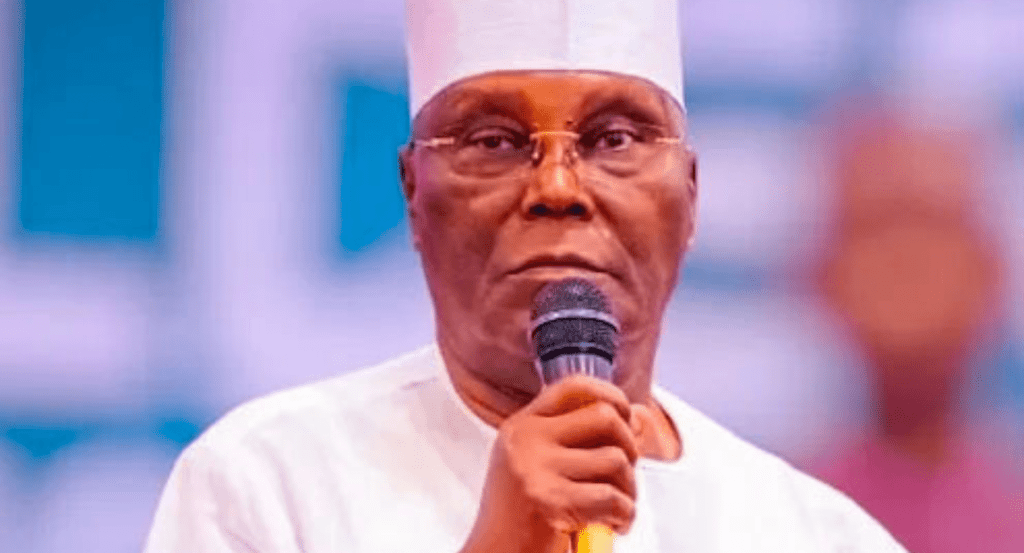

Ahead of the upcoming National Assembly debate on Nigeria’s tax reform bills, significant opposition has emerged from northern political leaders and groups, led by figures such as Atiku Abubakar and Governor Babagana Zulum of Borno State. The controversial tax reform proposals, which aim to overhaul the country’s taxation system, have faced growing criticism from northern leaders who argue that the bills could disproportionately benefit only the southern regions, particularly Lagos and Rivers states.

Atiku Abubakar, the former vice president, and Governor Zulum have been vocal in their opposition, stressing that the proposed reforms would primarily serve the interests of the economic hubs in the south, leaving the northern region at a disadvantage. The northern leaders fear that the bills could further widen the economic gap between the north and the south, where much of the country’s business activity is concentrated. According to them, the benefits of the reform would be skewed, especially with the proposed distribution of the increased revenue.

The situation intensified when the House of Representatives decided to suspend the debate on the tax reform bills indefinitely, following growing pressure from northern governors and lawmakers. The indefinite suspension of the debate underscores the level of discord among lawmakers regarding the proposed reforms. Governor Zulum has been particularly vocal in asserting that the tax reform bills would only bring prosperity to Lagos and Rivers, without considering the economic realities and needs of the northern states.

Northern groups, including prominent socio-cultural organizations such as Ohanaeze Ndigbo, Afenifere, and Arewa Youths, have also weighed in on the matter, expressing concerns about the fairness and inclusivity of the proposed reforms. They argue that the government must ensure that the tax structure addresses the needs of all regions, and not just the economic powerhouses of the south.

The tax reform bills are seen as an attempt by the federal government to restructure the country’s fiscal policies and boost its revenue. However, the controversial nature of the reforms suggests a challenging road ahead for policymakers as they try to balance the interests of different regions and ensure that the benefits are equitably distributed across the country.