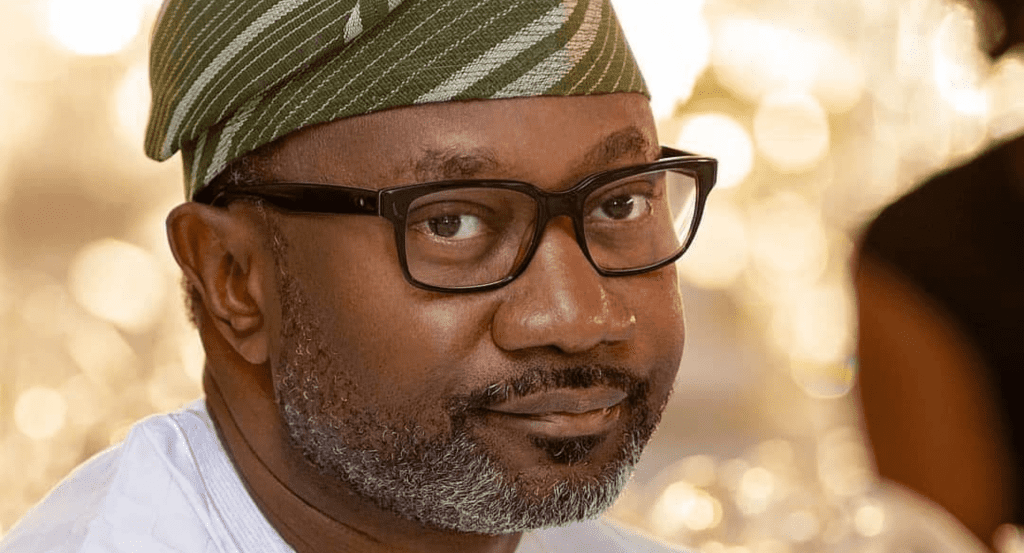

A group of shareholders of FBN Holdings (FBH) has initiated moves to remove billionaire businessman Femi Otedola as Chairman of the company. This development comes amid allegations of financial misconduct and growing concerns over corporate governance practices within the organization.

The shareholders, under the aegis of Concerned Shareholders of FBN Holdings, are calling for an Extraordinary General Meeting (EGM) to address their grievances. They allege that Otedola’s leadership has been tainted by questionable financial dealings, which they claim undermine the institution’s reputation and long-term stability.

In a letter to the Board of Directors, the shareholders outlined their demands, including the immediate removal of Otedola as chairman and a comprehensive review of the company’s governance structures. According to sources, the move was triggered by allegations that Otedola influenced key decisions to his personal advantage, a claim his camp has vehemently denied.

Otedola’s representatives have described the allegations as baseless and politically motivated, accusing detractors of attempting to destabilize the company. They maintain that his leadership has been instrumental in steering FBN Holdings towards growth and stability since his appointment in 2022.

Amid the controversy, FBN Holdings has assured stakeholders that the ongoing dispute has not impacted the company’s operations. In a statement, the management reaffirmed its commitment to corporate governance and expressed confidence in resolving the matter amicably.

“FBN Holdings remains a strong institution with robust operational frameworks. We urge all parties to follow due process in addressing their concerns,” the statement read.

Market analysts are closely monitoring the situation, warning that prolonged disputes could affect investor confidence and the company’s stock performance. However, others believe the company’s solid fundamentals will mitigate any short-term impact of the controversy.

As the call for an EGM gains traction, regulatory bodies such as the Central Bank of Nigeria (CBN) are expected to play a key role in ensuring transparency and accountability in resolving the matter. The CBN had previously intervened in FBN Holdings’ affairs to safeguard its financial stability, signaling its interest in maintaining order in the banking sector.

The coming weeks will determine the direction of this unfolding drama as shareholders and stakeholders navigate what could be a pivotal moment in the history of one of Nigeria’s oldest financial institutions.