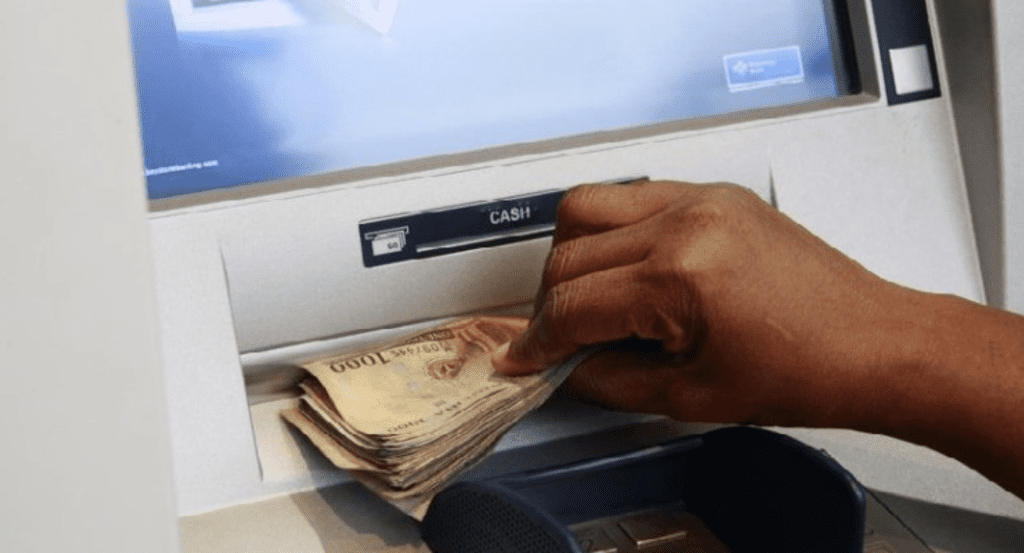

The Central Bank of Nigeria (CBN) has announced the discontinuation of free ATM withdrawals for customers using other banks’ ATMs, implementing new transaction fees effective March 1. This policy shift means that customers withdrawing money from ATMs not operated by their banks will now incur charges, a move that has sparked reactions among bank users and financial analysts.

According to the revised guidelines, the CBN has approved new withdrawal fees to be applied after a certain number of transactions. Previously, customers could make a limited number of free withdrawals from other banks’ ATMs before incurring charges. However, under the new directive, all such transactions will attract fees from the first withdrawal.

Financial experts suggest that the policy aims to reduce operational costs for banks and encourage the use of digital payment alternatives. However, many Nigerians have expressed concerns that the new charges will further strain consumers already dealing with economic difficulties. The development is expected to increase reliance on mobile banking, point-of-sale (POS) transactions, and other cashless payment options.

With the implementation date set for March 1, banks are expected to update their customers on the specific charges they will impose. The move aligns with the CBN’s broader efforts to regulate the banking sector and promote financial sustainability, but its impact on daily banking transactions remains a subject of debate.