A 2022 study by the Uganda Communications Commission (UCC) revealed that only 55% of people with disabilities (PWDs) in Uganda have access to mobile money services. This statistic highlights a major challenge in the country’s efforts to ensure equal access to financial services for everyone, regardless of physical or mental abilities.

Barriers to Mobile Money Access for Persons with Disabilities

The low level of mobile money access among PWDs can be attributed to several factors:

- Limited Accessibility: Many mobile money agents and service points are not physically accessible to people with disabilities. For example, individuals using wheelchairs may find it difficult to reach service centers due to poor infrastructure or lack of ramps.

- Lack of Tailored Services: Mobile money platforms are often not designed with accessibility in mind. Visually impaired users, for instance, may struggle with mobile apps that are not compatible with screen readers. Additionally, some PWDs may find it hard to navigate complex menu options or read small text on mobile devices.

- Low Digital Literacy: Another barrier is digital literacy. PWDs often face challenges accessing education, which impacts their ability to use digital tools, including mobile money platforms. Without proper training, some individuals may not understand how to use mobile phones or mobile money services effectively.

- Cost of Devices: The cost of mobile phones is also a significant issue for many PWDs. Some may rely on basic phones that lack advanced features, making it harder to use mobile money applications that require smartphones. Affordability remains a key challenge.

Efforts to Improve Accessibility

In recent years, various initiatives have been launched to improve financial inclusion for PWDs in Uganda.

- Government and UCC Initiatives: The Uganda Communications Commission and the government have been working to promote digital inclusion for marginalized groups, including PWDs. These efforts include pushing for more accessible technology and urging mobile service providers to create solutions tailored for PWDs.

- Telecommunication Companies’ Role: Some mobile service providers in Uganda, like MTN and Airtel, have started to implement services aimed at increasing accessibility. For example, MTN Uganda has developed apps that are more user-friendly for people with visual and hearing impairments. However, these services are still not widespread enough to reach all PWDs.

- NGO Support: Non-governmental organizations (NGOs) also play a crucial role in advocating for more inclusive financial services. Some NGOs offer digital literacy training to PWDs, helping them better understand how to use mobile money services. They also collaborate with service providers to develop more accessible mobile money solutions.

The Importance of Mobile Money for PWDs

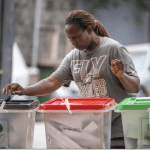

Access to mobile money is crucial for PWDs, as it offers them a convenient and safe way to handle their finances. Mobile money allows individuals to:

- Receive Financial Aid: Many PWDs depend on financial aid from family members, government grants, or NGOs. Mobile money provides a fast and secure way for them to receive these funds, especially for those living in remote areas where traditional banks are not available.

- Pay for Services: PWDs can use mobile money to pay for healthcare, transportation, and other essential services without needing to travel long distances to a bank. This is particularly important for those with mobility challenges.

- Start Small Businesses: Mobile money can also empower PWDs to start small businesses, especially in rural areas. With the ability to send and receive payments digitally, they can easily trade goods and services without needing to rely on cash.

Challenges Ahead

Despite the positive steps taken to address financial inclusion for PWDs, several challenges remain:

- Lack of Awareness: Many PWDs are still unaware of the mobile money services available to them. Increasing awareness through targeted campaigns is essential to ensuring they can fully benefit from these services.

- Affordability of Services: Although mobile money is cheaper than traditional banking, some PWDs still find it expensive. The fees charged for transactions can be a barrier, particularly for those who rely on small amounts of money for their daily needs.

- Ongoing Stigma: Social stigma around disability continues to be an issue. Some PWDs may hesitate to visit mobile money agents or service centers due to fear of discrimination or mistreatment.

The Road Ahead

To improve access to mobile money for PWDs, several key steps must be taken:

- Accessible Design: Mobile service providers must prioritize accessibility when designing their apps and services. This includes developing features like voice commands, larger text sizes, and simple navigation options for people with disabilities.

- Inclusive Infrastructure: Governments should work on improving infrastructure, making mobile money service points more accessible to people with physical disabilities. This could include building ramps and providing accessible customer service.

- Education and Training: There should be more focus on educating PWDs on how to use mobile phones and mobile money services. Telecommunication companies and NGOs can partner to provide training and support programs.

- Financial Inclusion Policies: Policymakers need to focus on creating financial inclusion strategies that specifically address the needs of PWDs. This includes reducing transaction costs for low-income users and ensuring that PWDs have access to affordable mobile devices.

Conclusion

Mobile money has the potential to transform the lives of people with disabilities in Uganda by offering them financial independence and the ability to manage their finances with ease.

However, with only 55% of PWDs currently using these services, there is a clear need for further action.

By addressing the barriers to access and improving digital literacy, Uganda can ensure that mobile money becomes a tool for empowerment, not exclusion, for its disabled population.