The Central Bank of Nigeria (CBN) has taken a firm stand against the collusion between banks and hawkers involved in illicit trading of newly minted naira notes. The regulatory body imposed a total fine of ₦150 million on multiple banks for their roles in releasing these notes to unauthorized vendors.

The scarcity of new naira notes has created a lucrative market for street traders, with some hawkers openly selling the notes at exorbitant rates. Investigations revealed that this black-market activity is sustained by collusion between some banking staff and hawkers, leading to an artificial scarcity that burdens ordinary Nigerians.

In a bid to curb these unethical practices, the CBN levied heavy fines on defaulting banks and warned of stricter sanctions for future violations. The regulator stressed the need for financial institutions to adhere strictly to cash distribution guidelines and ensure that new notes reach legitimate users through appropriate channels.

The ongoing scarcity has disrupted daily transactions, forcing many Nigerians to pay a premium to access cash. This development has compounded the financial strain on vulnerable populations already grappling with economic challenges.

Hawkers are reportedly charging exorbitant rates for new naira notes, with buyers paying up to ₦150 for ₦100 denominations. This illegal trade thrives due to lax oversight and internal compromises within the banking system.

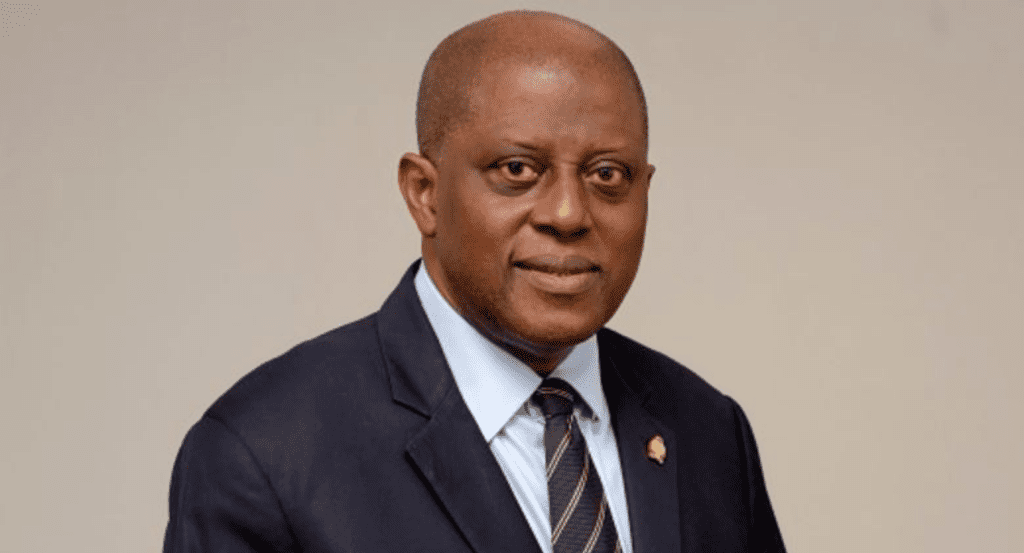

The CBN’s punitive measures are a warning to all financial institutions to prioritize transparency and integrity in their operations. Governor Olayemi Cardoso reiterated the apex bank’s commitment to addressing systemic challenges in the cash distribution process.

The CBN is intensifying monitoring efforts to eliminate loopholes that allow for illegal distribution. It also plans to launch public awareness campaigns to discourage citizens from patronizing street hawkers for cash transactions.

This enforcement action underscores the regulator’s resolve to maintain the credibility of the naira and ensure equitable access to cash for all Nigerians.