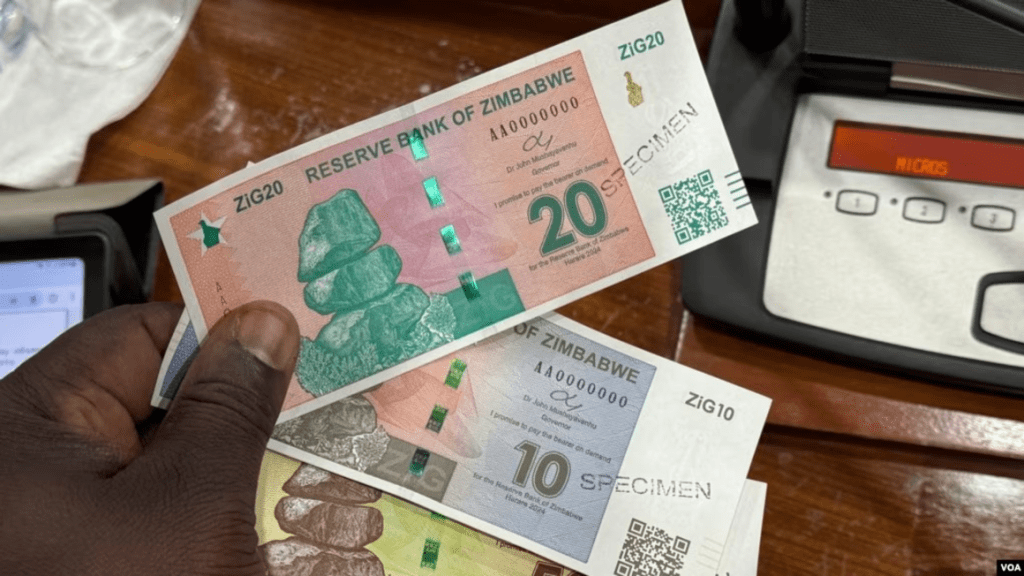

Zimbabwe introduced the Zimbabwe Gold (ZiG) currency in April 2024 to stabilize its economy, but it is already showing signs of significant depreciation. The ZiG, launched to curb the reliance on the US dollar, was meant to restore faith in the country’s local currency with backing by gold and foreign reserves. Despite initial stability, the currency’s value on the parallel market has dropped significantly from ZiG14.5 per USD to ZiG24 per USD. Economist Eddie Cross, an advisor to the government, suggests the ZiG could be on a downward spiral similar to the Zimbabwean dollar, which suffered extreme hyperinflation in the past. Analysts highlight issues with Zimbabwe’s foreign currency policies and informal market dominance as major obstacles to the currency’s success. The government is under pressure to address this volatility and stabilize the economy before transitioning fully away from the multicurrency system by 2030.