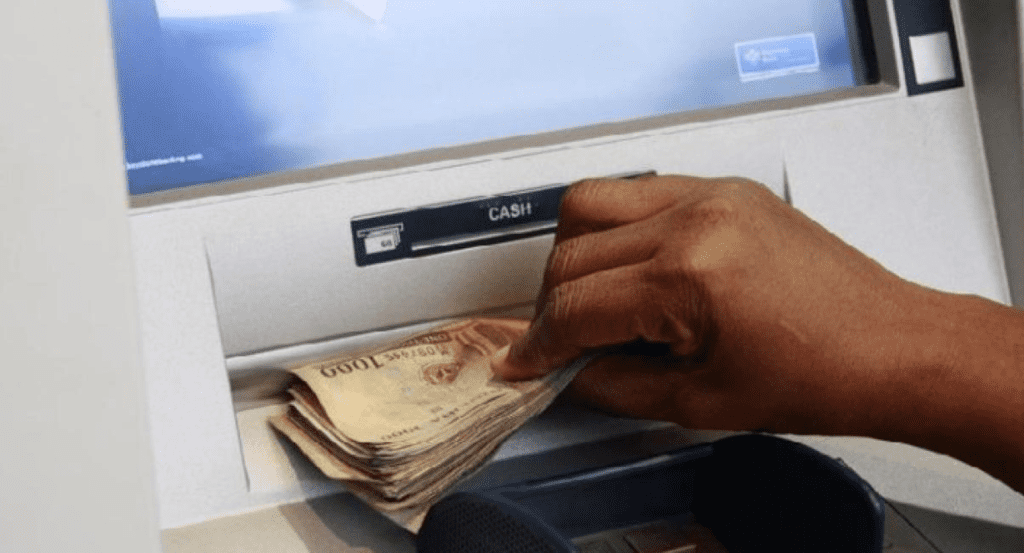

The implementation of the N100 withdrawal fee on Automated Teller Machines (ATMs) across Nigeria has triggered widespread reactions from bank customers and financial stakeholders. The fee, which came into effect on March 1, 2025, is in line with the new directive from the Central Bank of Nigeria (CBN), requiring commercial banks to charge customers N100 for cash withdrawals at ATMs after the first three transactions in a month.

Many Nigerians, already grappling with economic challenges, have expressed frustration over the additional financial burden imposed by the policy. Reports indicate that several ATMs, particularly in urban areas, have been stocked with cash, as banks anticipate increased withdrawals despite the charges.

SERAP Moves to Block the Fee

The Socio-Economic Rights and Accountability Project (SERAP) has taken legal action, urging President Bola Tinubu to direct the CBN to suspend the ATM fee hike until a court ruling is made on the matter. In a statement, SERAP emphasized that the policy could further impoverish Nigerians who depend on cash transactions for daily expenses.

“The implementation of this fee should be halted pending the outcome of a judicial review. Nigerians should not bear the brunt of policies that have not been properly assessed for their socio-economic impact,” the organization stated.

Customers Express Concerns

GTBank and Ecobank customers, among others, have been particularly vocal about their dissatisfaction. Many fear that the N100 charge, coupled with existing bank deductions, will significantly reduce their available funds. Some customers have also raised concerns about hidden charges that may emerge as banks adjust to the new policy.

A Lagos-based entrepreneur, Adeola Okafor, described the situation as unfair. “We are already dealing with high inflation, rising fuel prices, and now this. The banking sector should be working to ease financial transactions, not make them more difficult,” he said.

Banks Justify Charges

Despite the backlash, banks argue that the fee is necessary to cover operational costs associated with cash withdrawals and ATM maintenance. An anonymous senior banking official stated that the policy aligns with global banking standards where ATM withdrawals are not entirely free after a limited number of transactions.

“This is not a move to exploit customers but rather to streamline banking operations and encourage digital transactions,” the official explained.

With the matter now in court and public outcry growing, financial analysts believe the Nigerian government may be forced to intervene. Until then, customers must adjust to the new banking reality while hoping for a favorable resolution.