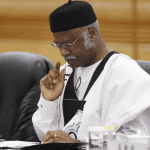

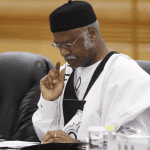

The Organization of the Petroleum Exporting Countries (OPEC) has reiterated its commitment to unlocking Africa’s vast oil reserves, urging the continent’s leaders to resist what it calls “misguided policies” that could hinder energy development. OPEC Secretary-General, Haitham Al Ghais, emphasized that Africa holds over 120 billion barrels of proven crude oil reserves, which, if properly developed, could significantly boost economic growth, energy security, and job creation.

Speaking at a recent energy forum, Al Ghais warned African nations against rushing into an energy transition that could undermine their economic stability. Instead, he called for increased investments in oil exploration and production, stressing that fossil fuels will remain a crucial part of the global energy mix for decades.

Africa’s Oil Potential: A Game-Changer for Economic Growth

Africa’s oil sector has long been considered one of the most underutilized resources in the global energy market. According to OPEC, the continent is home to some of the largest untapped crude oil deposits, particularly in countries like Nigeria, Angola, Libya, Algeria, and Ghana. These reserves, if properly exploited, could help address energy poverty, create jobs, and drive industrialization.

However, many African nations have faced challenges in attracting investment, navigating environmental concerns, and dealing with shifting global energy policies. The growing push for renewable energy and carbon reduction has placed additional pressure on African governments to scale down fossil fuel production. OPEC argues that such policies, if not carefully implemented, could leave Africa at an economic disadvantage.

OPEC’s Stand: Don’t Rush the Energy Transition

OPEC has repeatedly emphasized that the world’s energy transition must be “inclusive, realistic, and fair”, taking into account the unique economic challenges of developing regions. Al Ghais stated that Africa should not abandon its oil potential prematurely, especially when many developed nations still rely heavily on fossil fuels.

“It is concerning to see some narratives that seek to pressure African nations into reducing oil production when the reality is that global demand for energy continues to rise,” Al Ghais noted.

OPEC’s position aligns with the stance of several African oil-producing nations that argue for a balanced approach to energy development, where fossil fuels remain a significant part of their energy mix while also pursuing renewables at a sustainable pace.

Challenges Hindering Africa’s Oil Development

Despite the vast reserves, Africa’s oil industry faces several obstacles that limit its ability to maximize production. These include:

- Investment Shortfalls: Many international investors have shifted focus toward renewable energy, reducing funding for African oil projects.

- Regulatory and Political Instability: Some African nations struggle with inconsistent energy policies, contract disputes, and political risks that deter major oil investments.

- Infrastructure Gaps: Insufficient refining capacity and outdated pipeline networks make it difficult to fully harness oil resources for local and export markets.

- Environmental Concerns: Global climate change policies and local environmental issues have led to restrictions on new exploration projects.

OPEC argues that while climate change concerns are valid, Africa should be allowed to utilize its oil resources responsibly while also gradually integrating cleaner energy sources.

The Role of Foreign Investment in Unlocking Africa’s Oil Wealth

OPEC is calling for increased foreign investment in Africa’s oil and gas sector, highlighting the need for technological partnerships, improved regulatory frameworks, and infrastructure development. Countries like China, Russia, and Middle Eastern Gulf nations have already shown interest in expanding oil investments in Africa, while Western nations remain cautious due to climate policies.

Nigeria, Africa’s largest oil producer, has been actively seeking foreign investments to boost its petroleum sector. The country recently introduced new policies aimed at attracting investors, including reforms in its oil and gas regulatory framework. Similarly, Angola and Ghana have been making efforts to modernize their oil production processes and attract multinational energy companies.

Global Oil Demand and Africa’s Strategic Position

Despite the global push for renewable energy, oil remains the world’s primary energy source, with demand projected to stay strong in the coming decades. According to OPEC forecasts, global oil demand will continue to rise, driven by economic growth in Asia, industrial expansion, and transportation needs.

Africa, with its vast reserves, is positioned to play a crucial role in supplying the global energy market. OPEC believes that by strengthening oil production capacities, modernizing refineries, and enhancing export channels, Africa can establish itself as a key player in the global energy landscape.

OPEC’s call for Africa to unlock its 120 billion barrels of oil reserves underscores the strategic importance of fossil fuels in the continent’s economic future. While the global shift toward renewable energy is inevitable, OPEC insists that Africa must not be forced into an energy transition that compromises its economic stability and development.

By prioritizing investment, infrastructure, and policy reforms, African nations can fully leverage their oil potential while gradually embracing cleaner energy solutions. As the debate on energy transition continues, the challenge remains: how can Africa balance economic growth with sustainability without sacrificing its natural resources?