Microfinance has emerged as a vital component of Ghana’s economy, providing essential financial services to underserved populations. This article explores the impact of microfinance on small businesses and economic development in the country.

Microfinance Overview

Microfinance refers to the provision of financial services to individuals and small businesses that lack access to traditional banking. In Ghana, the microfinance sector has experienced significant growth, with numerous microfinance institutions (MFIs) emerging to serve the needs of entrepreneurs and low-income households.

The Ghanaian government has recognized the importance of microfinance in promoting financial inclusion and has implemented policies to support the sector’s development. The Bank of Ghana has also established regulatory frameworks to ensure the sustainability and accountability of MFIs.

Impact on Small Businesses

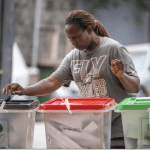

Microfinance has played a crucial role in empowering small businesses across Ghana. Access to microloans has enabled entrepreneurs to start and expand their ventures, contributing to job creation and economic growth. Many small businesses, particularly in rural areas, rely on microfinance to finance their operations and invest in essential resources.

For instance, women entrepreneurs have benefited significantly from microfinance services, allowing them to establish businesses that generate income for their families. By providing access to capital, microfinance has contributed to poverty alleviation and improved living standards.

Challenges Facing the Microfinance Sector

Despite its positive impact, the microfinance sector in Ghana faces several challenges. One of the primary concerns is the sustainability of MFIs, as many struggle with high default rates and inadequate risk management practices. The regulatory environment, while supportive, still requires strengthening to protect clients and ensure the long-term viability of microfinance institutions.

Additionally, financial literacy remains a significant barrier for many borrowers. A lack of understanding about loan terms and repayment obligations can lead to over-indebtedness and financial distress. Efforts to enhance financial education and awareness among clients are essential for the sector’s continued success.

Future Prospects

The future of microfinance in Ghana appears promising, with continued efforts to expand access to financial services. The use of technology, particularly mobile banking, is revolutionizing the microfinance landscape. Mobile platforms enable MFIs to reach remote communities, providing essential financial services to those previously excluded from the formal banking system.

Moreover, partnerships between MFIs and other stakeholders, such as government agencies and NGOs, can enhance the sector’s reach and impact. Collaborative efforts to provide training, mentorship, and business development support will further empower entrepreneurs and strengthen the microfinance ecosystem.

Conclusion

In conclusion, microfinance plays a critical role in Ghana’s economy, fostering entrepreneurship and promoting financial inclusion. While challenges remain, the sector’s growth and potential for innovation offer hope for many aspiring entrepreneurs. By addressing the challenges and leveraging technology, Ghana can continue to harness the power of microfinance to drive economic development and improve the livelihoods of its citizens.