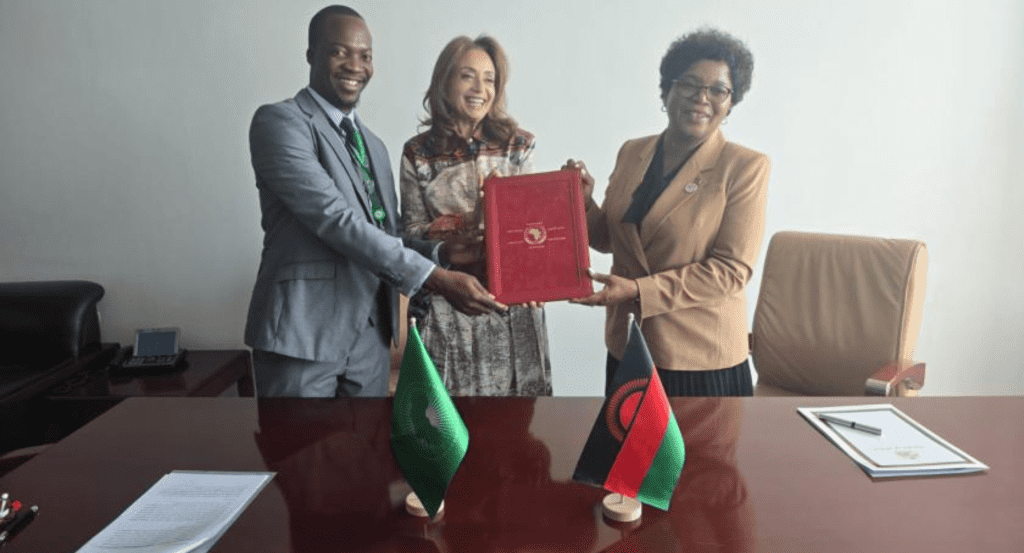

The Federal Government of Nigeria has inaugurated 50 commissioners for the Tax Appeal Tribunal (TAT) as part of ongoing economic reforms aimed at improving revenue generation and tackling tax evasion. The move comes ahead of the anticipated passage of key tax reform bills designed to enhance compliance and streamline the country’s tax administration.

During the inauguration ceremony in Abuja, Minister of Finance and Coordinating Minister of the Economy, Wale Edun, emphasized the importance of a fair and efficient tax dispute resolution system. He noted that the newly appointed commissioners, drawn from diverse professional backgrounds, would play a critical role in addressing disputes between taxpayers and tax authorities, ultimately fostering trust in the system.

The Tax Appeal Tribunal, established under the Federal Inland Revenue Service (FIRS) Act, serves as an independent body for resolving tax-related disputes outside conventional courtrooms. With the increasing complexity of tax laws and the government’s push for stricter compliance, the role of the tribunal has become more significant. The new commissioners are expected to expedite case resolutions, reduce litigation burdens on businesses, and ensure that tax assessments are handled fairly.

In recent months, the Nigerian government has intensified efforts to widen the tax net and curb evasion, particularly among high-income earners and corporate entities. The administration has also introduced various digital tools to enhance tax collection and monitoring. The inauguration of the new commissioners aligns with broader strategies to increase non-oil revenue and reduce Nigeria’s dependence on crude exports.

Meanwhile, stakeholders have expressed optimism about the tribunal’s strengthened capacity. Experts believe that faster dispute resolution will encourage businesses to comply with tax obligations without fear of unfair treatment. However, concerns remain about bureaucratic hurdles and the enforcement of tribunal rulings, which have sometimes faced delays in the past.

As the government pushes for tax reforms, the National Assembly is expected to pass new tax-related bills that will further simplify regulations and improve enforcement mechanisms. The combination of legislative backing, a strengthened appeal process, and enhanced digital monitoring is seen as a comprehensive approach to addressing Nigeria’s tax challenges.

With the new commissioners in place, businesses and individuals engaged in tax disputes will have an opportunity to seek redress more efficiently, while the government aims to achieve its revenue targets in a fair and transparent manner.