Paga, a Nigerian fintech startup, has officially launched its digital payments platform in Gambia, marking a significant expansion of its services across West Africa. The company aims to provide seamless payment solutions that enhance financial inclusion and accessibility for individuals and businesses in the region.

Paga, a Nigerian fintech startup, has officially launched its digital payments platform in Gambia, marking a significant expansion of its services across West Africa. The company aims to provide seamless payment solutions that enhance financial inclusion and accessibility for individuals and businesses in the region.

Founded in 2009, Paga has established itself as a key player in the African fintech landscape, with a focus on simplifying financial transactions for users. The expansion into Gambia is part of Paga’s strategy to reach new markets and empower local economies through technology.

Features of the Paga Platform

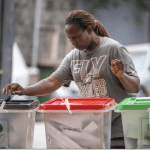

The Paga platform allows users to send and receive money, pay bills, and make purchases online and offline. With the launch in Gambia, Paga aims to provide an easy-to-use interface that enables users to conduct transactions securely and efficiently.

The platform is expected to benefit both consumers and merchants by offering various payment options, including mobile money and bank transfers. This versatility is particularly significant in Gambia, where a considerable portion of the population remains unbanked.

Strengthening Financial Inclusion

In a statement, Paga’s CEO, Tayo Oviosu, emphasized the importance of expanding digital payments to underserved markets. “Gambia presents a unique opportunity for us to extend our mission of providing access to financial services for everyone,” he said. “Our platform will facilitate easier transactions and empower local businesses to thrive.”

By enhancing financial inclusion, Paga aims to bridge the gap for individuals who lack access to traditional banking services. The startup’s entry into Gambia is expected to stimulate economic growth by enabling more people to participate in the formal financial system.

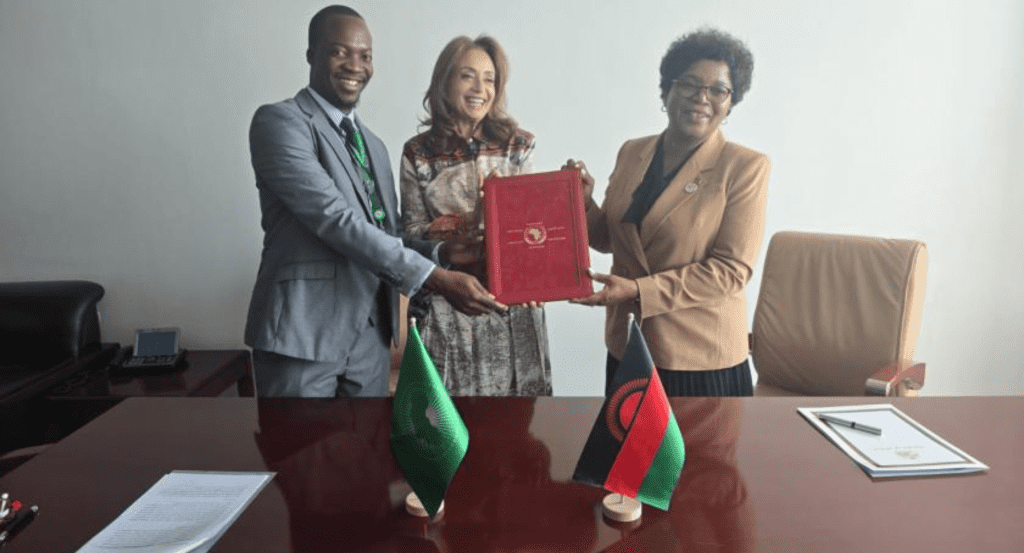

To facilitate its expansion, Paga has formed partnerships with local stakeholders, including financial institutions and regulatory bodies. These collaborations will help ensure compliance with local laws and enhance the platform’s effectiveness in meeting the needs of Gambian users.

The launch in Gambia is part of Paga’s broader growth strategy in West Africa. Following its success in Nigeria, where it has over 17 million users, the startup plans to explore further opportunities in neighboring countries, enhancing its regional footprint.

As Paga begins operations in Gambia, the company is committed to ongoing improvements and updates to its platform based on user feedback. This user-centric approach is designed to foster trust and reliability among Gambian customers.

With the expansion into Gambia, Paga continues to lead the charge in the fintech revolution across West Africa. The startup’s innovative digital payment solutions are poised to transform the financial landscape, providing users with convenient and secure ways to manage their money.

As Paga embarks on this new chapter, the focus remains on empowering individuals and businesses, ultimately contributing to the growth and stability of the Gambian economy.