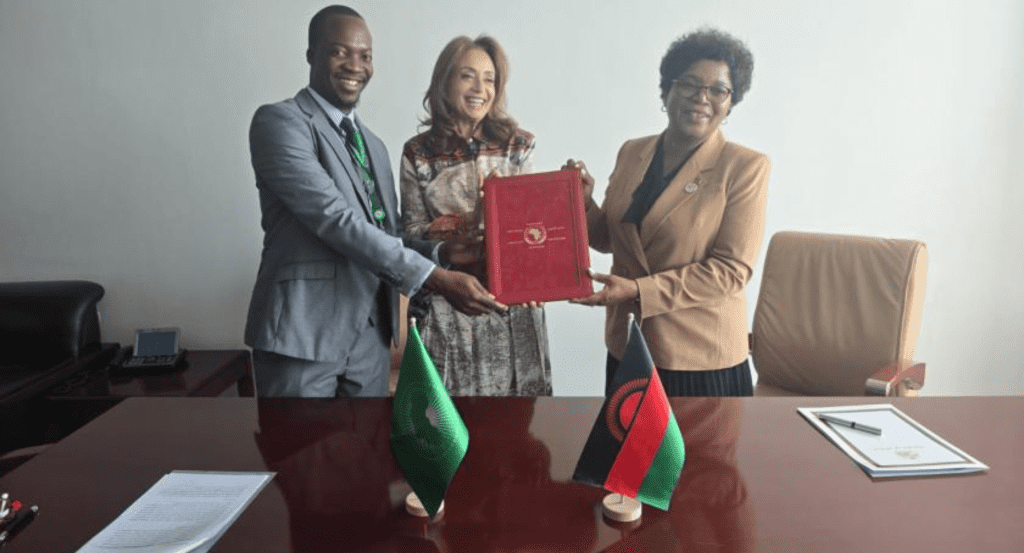

Global payment giant Visa has announced a strategic investment in Moniepoint, one of Africa’s leading fintech companies, as part of efforts to drive financial inclusion and empower small and medium enterprises (SMEs) across the continent. This partnership aims to address the financial challenges faced by businesses and individuals, especially in underserved areas.

Moniepoint, which has already established itself as a key player in the African fintech ecosystem, provides banking and payment solutions to millions of businesses. The company has been instrumental in extending financial services to previously unbanked and underbanked populations. With Visa’s backing, Moniepoint is poised to scale its operations and expand its offerings, ensuring more SMEs have access to credit, digital payments, and other financial tools.

The collaboration will see Moniepoint leveraging Visa’s extensive network and technological expertise to enhance its services. This includes enabling SMEs to accept Visa payments and providing them with access to global markets. By bridging the gap between local businesses and international opportunities, the partnership aims to unlock significant economic growth in the region.

Speaking on the partnership, Visa’s Head of Strategic Investments highlighted the company’s commitment to fostering financial inclusion globally. “Moniepoint’s impact on African businesses aligns with our mission to empower underserved communities. This investment reinforces our belief in the transformative power of technology and partnerships to drive economic development,” he said.

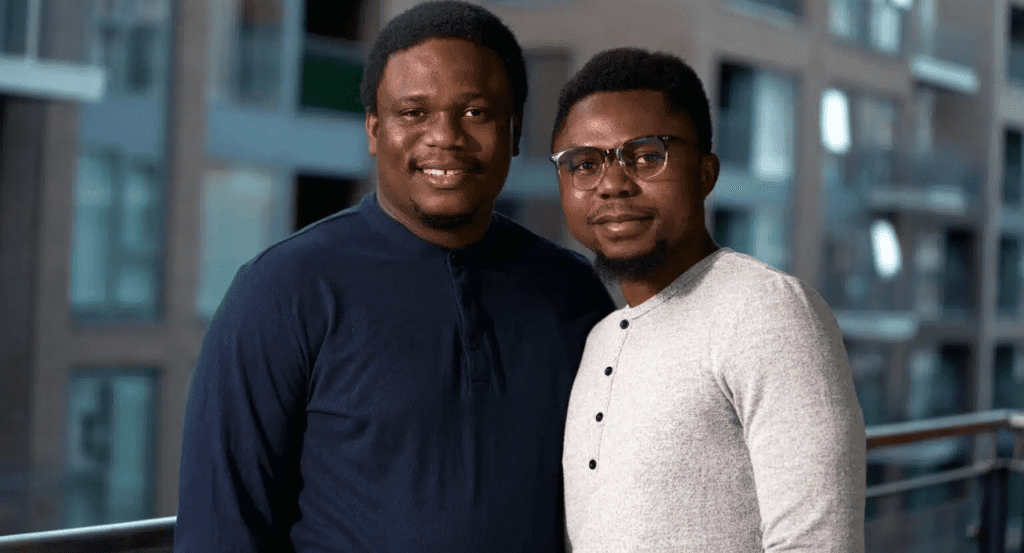

The CEO of Moniepoint, Tosin Eniolorunda, expressed excitement about the partnership, describing it as a major milestone for the company. “Visa’s investment validates our mission to provide comprehensive financial services to businesses across Africa. Together, we can accelerate the adoption of digital payments and enhance access to critical financial products,” Eniolorunda stated.

This development comes at a time when the African fintech sector is experiencing rapid growth, with increasing investor interest and a surge in digital adoption. Visa’s investment in Moniepoint underscores the potential of African startups to create innovative solutions tailored to local needs while addressing global challenges.

Industry experts have lauded the move, noting that it will strengthen Moniepoint’s position as a leader in the fintech space and set a benchmark for similar collaborations. With the backing of Visa, Moniepoint is expected to accelerate financial inclusion efforts, particularly in rural and underserved regions, thereby driving economic empowerment for millions.