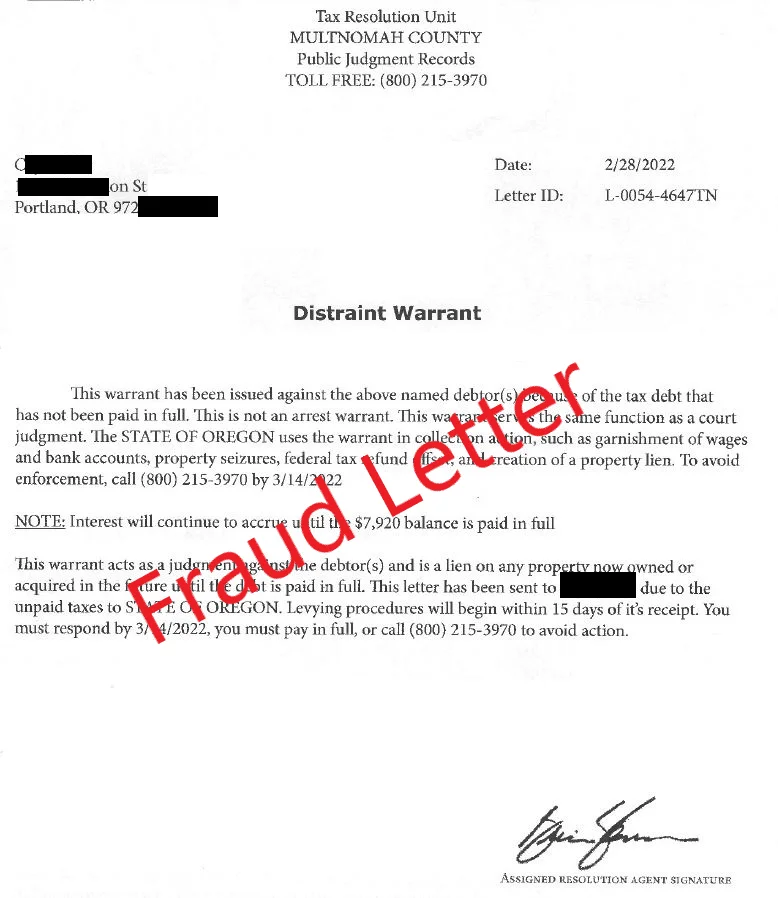

The online letter scam, also known as advance fee fraud or “419 fraud,” is a scheme where the sender requests help facilitating the illegal transfer of money. The letter may be sent by mail, fax, or email—the most common method. The author is typically a self-proclaimed government or military official, bank officer, or business executive, who claims they need access to a foreign account to transfer money.

In exchange, the sender offers the recipient a commission—sometimes up to several million dollars, depending on the perceived gullibility of the target. The scammers then request money to cover costs associated with the transfer, such as taxes, legal fees, or bribes to government officials. If successful, the scammers either disappear immediately or ask for more money by inventing additional transfer problems.

Key Takeaways

- The online letter scam is a scheme where the sender offers a commission to someone—generally via email—to help transfer a large sum of money.

- Scammers rely on the promise of commission to entice recipients into sending money to strangers.

- Common reasons given for the transfer include frozen accounts, inheritance with no beneficiary, or money held hostage due to war or corruption.

- Online letter scams are also known as advance fee fraud or 419 fraud.

- The term “419 fraud” comes from Section 419 of the Nigerian Criminal Code, which prohibits such scams, though the scheme is not limited to Nigeria.

How an Online Letter Scam Works

Though commonly associated with Nigeria, the online letter scam is used worldwide. Some claim the scam originated in Nigeria in the 1970s, while others suggest it traces back to older confidence schemes, like the Spanish Prisoner scam.

Initially, these scams were conducted by phone, fax, and traditional mail, but email has become the primary medium. Signs of a scam message include mentions of U.S. currency held overseas, promises of large compensation for little effort, and messages filled with typos or grammatical errors.

What the Scammers Want

Scammers try to exploit the target’s greed or goodwill by offering large commissions, hoping the recipient will risk sending money. They may claim the funds are blocked due to government actions or need to be transferred for safekeeping during political unrest. Often, scammers ask for the recipient’s bank account details to make the transfer seem legitimate.

Always remember: if something sounds too good to be true, it usually is. These scams persist because only a few victims need to fall for them to make the effort worthwhile.

How to Avoid the Online Letter Scam

The U.S. Federal Bureau of Investigation (FBI) suggests the following tips to avoid falling victim to online letter scams:

- Do not reply to letters or emails from people requesting personal or banking information to transfer funds. Forward the letter to the U.S. Secret Service, the FBI, or the U.S. Postal Inspection Service.

- Be skeptical of foreign officials or individuals offering large sums of money.

- Never believe promises of big payouts for minimal effort.

- Guard your account information carefully and do not share it with strangers.

- Report scams to the FBI or U.S. Secret Service if you know someone who might be corresponding with a scammer.

These scams continue to succeed because scammers only need a few victims to make their schemes profitable. Be especially mindful of elderly individuals or those unfamiliar with digital fraud, as they are common targets.

What Is the Online Romance Scam?

In a romance scam—a form of catfishing—a fraudster creates a fake online identity to gain a victim’s trust and affection. These criminals exploit romantic connections to manipulate victims emotionally and financially. They may promise marriage or propose meeting in person, but the meeting never materializes. Eventually, the scammer requests money.

According to research from cybersecurity company TechShielder, Nigeria ranks second globally in romance scams, following the Philippines.

What Is an Advance Fee Scam?

An advance fee scam involves the victim paying an upfront amount with the expectation of receiving something of greater value in return, such as a gift, contract, or investment. However, the victim receives nothing or is asked for additional payments to solve invented problems.

The online letter scam is a typical example of advance fee fraud, where the victim is promised a cut of large funds in exchange for their banking details and some upfront payments.

Are All Online Letter Scams From Nigeria?

No, not all of these scams originate in Nigeria. In fact, investigations show that 71% of identified perpetrators were based in the United States, with Nigeria accounting for only 8%.

Reporting Online Letter Scams

If you believe you have fallen victim to an online letter scam, report it to the U.S. Secret Service, the FBI, or the Office of Homeland Security. If there is no financial loss, label the report as “No Financial Loss – For Your Database.” However, if you experienced a financial loss, submit your case to the nearest Secret Service field office.

To report suspected scams, forward the emails to spam@uce.gov so that the Federal Trade Commission (FTC) can investigate.

Conclusion

Online letter scams persist because they exploit human emotions like greed and trust. Awareness is the best defense—being cautious and vigilant about unsolicited messages promising rewards can prevent you from falling victim to these fraudulent schemes. Encourage others, especially vulnerable individuals, to be skeptical and informed about how these scams operate.