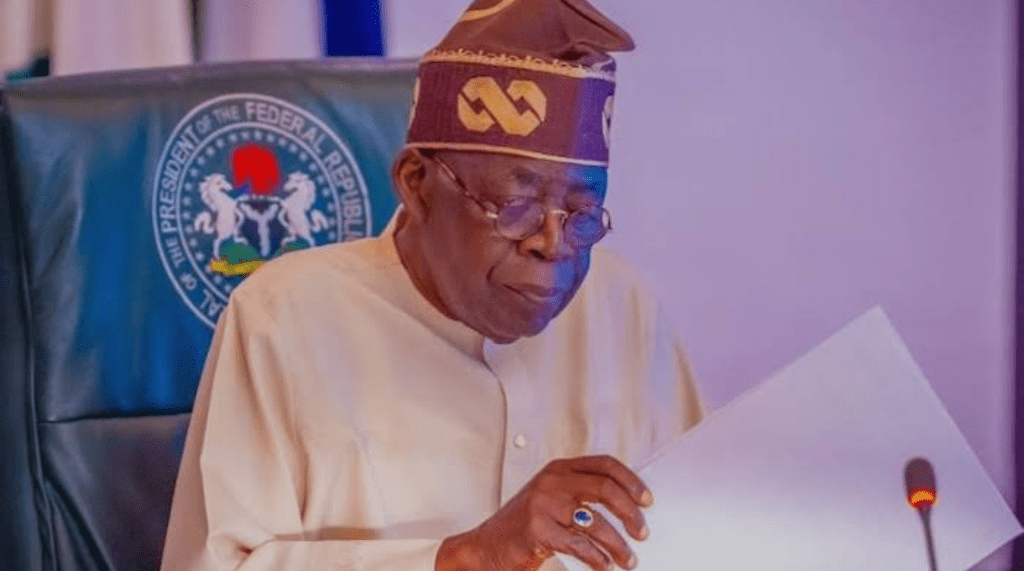

In a move reflecting the complex challenges of reforming Nigeria’s tax system, the Nigerian government has announced its intention to withdraw four tax reform bills recently submitted to the National Assembly. These bills, introduced in September 2024, are part of a broader strategy to overhaul the nation’s tax structure and increase revenue. However, the bills have met significant opposition, particularly from leaders in Nigeria’s northern states, who argue that the proposed changes could unfairly impact their region.

The crux of the opposition stems from a proposed restructuring of the Value Added Tax (VAT) distribution model. Currently, VAT revenue is collected centrally and distributed among the states, but states with larger economies and greater consumption, primarily in the south, generate a significant portion of this revenue. Under the new proposal, the distribution model would shift, potentially limiting the funds that less economically active states, predominantly in the north, would receive. Northern leaders argue that this change would exacerbate existing regional inequalities, as many northern states depend heavily on these federal allocations due to lower tax revenue and economic activity within their borders.

The National Economic Council (NEC), chaired by Vice President Kashim Shettima, has taken the lead in addressing these concerns. In recent consultations with key stakeholders, the NEC acknowledged the objections raised by the northern governors and recommended the withdrawal of the bills to allow for a more extensive and inclusive review process. According to sources close to the council, the decision to retract the bills highlights the administration’s commitment to equitable reform, ensuring that any policy changes do not unfairly disadvantage certain regions.

For Vice President Shettima and the NEC, the objective remains to create a tax system that is both fair and capable of supporting Nigeria’s broader economic goals. The council’s recommendation emphasizes the need for further stakeholder consultations that include representatives from various regions and sectors. In their view, only through a balanced approach can the government achieve the revenue growth it seeks while maintaining national cohesion.

The government has committed to revisiting the reforms through a more inclusive process, gathering input from diverse stakeholders, including regional leaders, economists, and tax experts. The revised bills are expected to be reintroduced to the National Assembly in the coming months, incorporating adjustments that address regional disparities and ensure a fair distribution of tax revenue.

This development underscores the complexity of tax reform in Nigeria, where economic, regional, and political factors intersect. For northern leaders, the temporary withdrawal of the bills is a critical opportunity to advocate for a framework that recognizes the unique economic challenges of their states. Conversely, proponents of the reform argue that it is necessary for Nigeria to modernize its tax system to create a more sustainable revenue base that reduces dependency on oil revenue