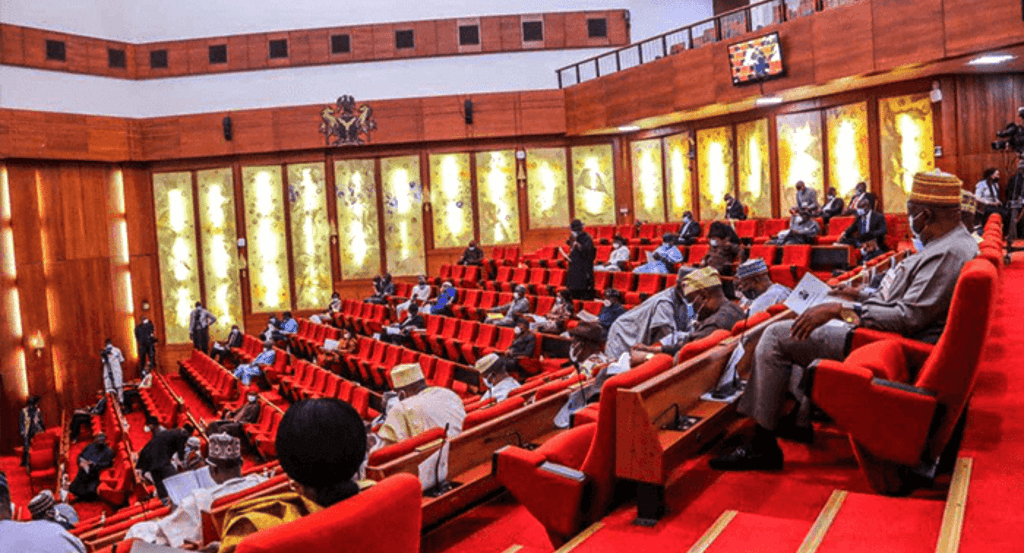

The Senate has intensified discussions on President Bola Tinubu’s Tax Reform Bills, taking significant steps to ensure their effectiveness. A special committee has been set up to engage with the Federal Government, addressing stakeholder concerns while aligning the bills with Nigeria’s economic priorities.

Presidential aides have highlighted the reforms’ potential to significantly boost state revenues, enabling states to finance infrastructure and public services more efficiently. Organizations such as the Chartered Institute of Taxation of Nigeria (CITN), PENGASSAN, and Nigeria Employers’ Consultative Association (NECA) have provided input, emphasizing transparency, preventing over-taxation, and addressing implementation challenges. Bishop Matthew Kukah has also urged inclusive dialogue to avoid public dissent.

The reforms aim to streamline the tax system, reduce redundancies, and broaden the tax base. Critics, however, have raised concerns about potential hardships for lower-income groups and small businesses. By fostering dialogue and collaboration, the Senate seeks to refine the bills for greater acceptance and long-term benefits.

These reforms mark a crucial moment for Nigeria’s fiscal future, with stakeholders advocating for equity, fairness, and sustainable development throughout their implementation.