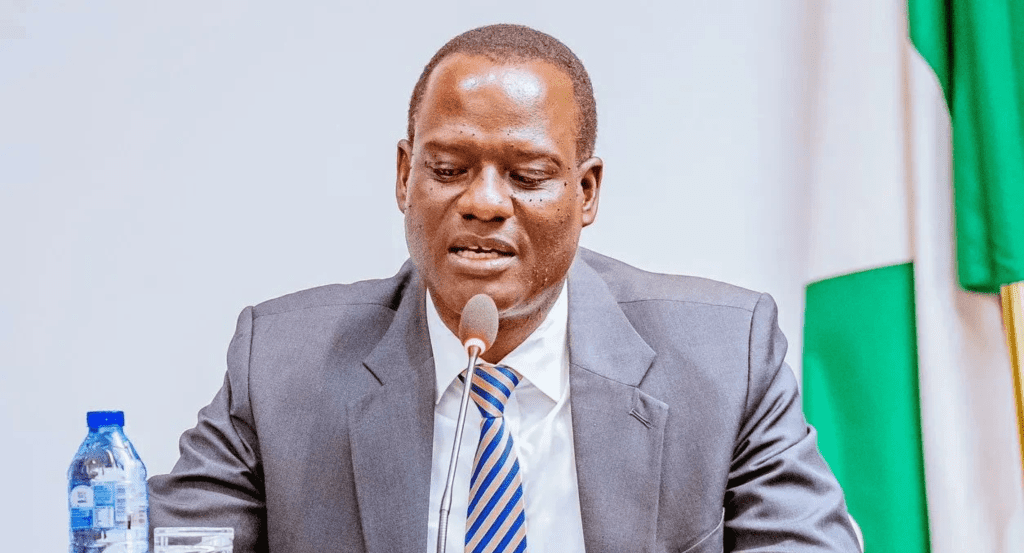

President Bola Tinubu’s administration has introduced tax reforms designed to alleviate the financial burden on vulnerable Nigerians while improving the nation’s fiscal framework. This was disclosed by Taiwo Oyedele, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, during recent discussions with stakeholders.

Oyedele emphasized that the reforms are not solely about taxation but also include fiscal policy adjustments to create a more equitable system. He noted that the current tax-to-GDP ratio in Nigeria, which stands at approximately 10%, is among the lowest globally, underscoring the need for reform.

Under the initiative, tax policies are being streamlined to reduce the complexity of compliance and eliminate redundant levies. These changes aim to encourage investment, boost economic productivity, and ultimately reduce poverty levels. Oyedele revealed that Nigerians currently pay about ₦1.5 trillion in taxes annually despite generating an income of ₦15 trillion, which highlights inefficiencies in the tax system.

In a related development, Senator Adams Oshiomhole has advised state governors to engage in negotiations to ensure fair tax bills. Speaking at an event, Oshiomhole stated, “You get what you negotiate,” urging state leaders to collaborate with the federal government to address the concerns of their constituents.

Oshiomhole also highlighted the need for governments at all levels to improve transparency and accountability in utilizing tax revenue. His remarks underscore the broader challenge of building public trust in the tax system.

The reforms aim to reduce the tax burden on vulnerable groups while ensuring that wealthier individuals and corporations contribute their fair share. Oyedele stated that these measures would result in a more balanced distribution of resources and improve public services for all Nigerians.

Critics, however, have expressed concerns about the implementation of the reforms, calling for clarity on how the changes will address longstanding issues such as multiple taxation and misuse of public funds. Advocacy groups have urged the government to adopt a phased approach to ensure a smooth transition and avoid unintended consequences for businesses and households.

As the government continues to roll out these reforms, Nigerians are hopeful that the changes will lead to a fairer tax system and drive economic growth, particularly for vulnerable populations.