Traditional banks in Ghana are fast becoming relics of the past. As fintech takes center stage, digital wallets and mobile payment systems are rapidly transforming the financial landscape. But can fintech truly revolutionize financial inclusion, or will it simply deepen the divide between the haves and have-nots?

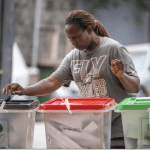

The rise of fintech in Ghana is nothing short of a revolution. Companies like MTN Mobile Money have become household names, offering financial services to millions who were previously excluded from the banking system. This is particularly significant in rural areas, where traditional banks have failed to establish a meaningful presence.

However, while fintech has made impressive strides in democratizing financial access, significant challenges remain. Regulatory oversight is still catching up with the rapid pace of innovation, leaving gaps in consumer protection and cybersecurity. Moreover, while mobile money platforms are widely adopted, more complex financial services—such as microloans and insurance—are not yet as accessible to the average Ghanaian.

The real test for Ghana’s fintech industry will be its ability to evolve beyond basic services and offer comprehensive financial products that meet the needs of all Ghanaians. Only then will fintech fulfill its promise of true financial inclusion.

Conclusion:

Ghana’s fintech revolution is well underway, but the industry must continue to innovate and address regulatory challenges if it is to achieve its full potential in promoting financial inclusion.