MTN Group, Africa’s leading telecommunications giant, has officially exited the Guinea-Conakry market, concluding the sale of its subsidiary to the Government of Guinea. This strategic move is part of MTN’s ongoing efforts to streamline its portfolio and focus on high-growth markets.

- MTN announced that the transaction was finalized on December 31, 2024, marking the end of its operations in Guinea after nearly two decades.

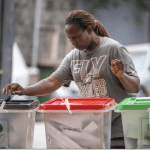

- The sale aligns with the government’s ambition to nationalize key industries, ensuring greater local control of strategic sectors.

Reasons Behind MTN’s Exit

- Portfolio Optimization:

The sale reflects MTN’s strategy to exit less profitable markets and reallocate resources to core markets with high growth potential. - Challenging Business Environment:

- Guinea’s regulatory and economic challenges have posed significant hurdles for private telecom operators.

- The nationalization aligns with the government’s broader objectives of bolstering local industry control.

The Government of Guinea stated that the acquisition would enhance local access to telecommunications services and promote digital inclusion. The administration plans to modernize the network infrastructure and integrate it into broader national development plans.

MTN’s Regional Commitment

Despite the exit, MTN reaffirmed its commitment to West Africa, where it remains a major player in countries like Nigeria, Ghana, and Côte d’Ivoire. The group emphasized that the decision was purely strategic and not reflective of broader disengagement from the region.

- Opportunities for Growth:

- The government-led telecom initiative could lower costs for consumers and expand rural network coverage.

- Concerns About Efficiency:

- Some industry analysts question whether the state-owned model can maintain the efficiency and innovation seen under private-sector management.

MTN’s exit underscores a growing trend among multinational corporations reassessing their presence in smaller or less profitable markets. This move also highlights the increasing role of governments in reclaiming control over critical industries.