The Nigerian Senate has put a temporary halt to discussions on the proposed tax reform bills following concerns raised by various stakeholders, including state governors and private sector leaders. The suspension comes as the Senate seeks to address key issues and ensure the reforms align with national economic priorities.

The reform bills, initiated by the Tinubu administration, aim to restructure Nigeria’s tax system to boost government revenue, reduce reliance on oil exports, and improve economic efficiency. However, the proposals have drawn criticism, with some stakeholders arguing that the changes could place undue burdens on businesses and citizens.

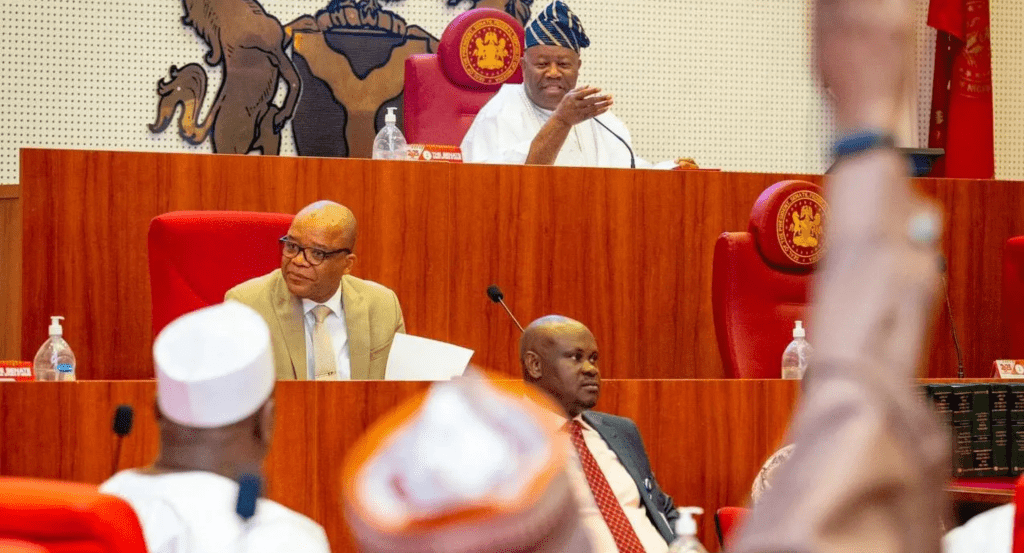

Senate President Godswill Akpabio confirmed the suspension, stating that further deliberations would resume only after critical consultations with stakeholders. He emphasized the need for the reforms to address economic challenges without exacerbating hardship for Nigerians.

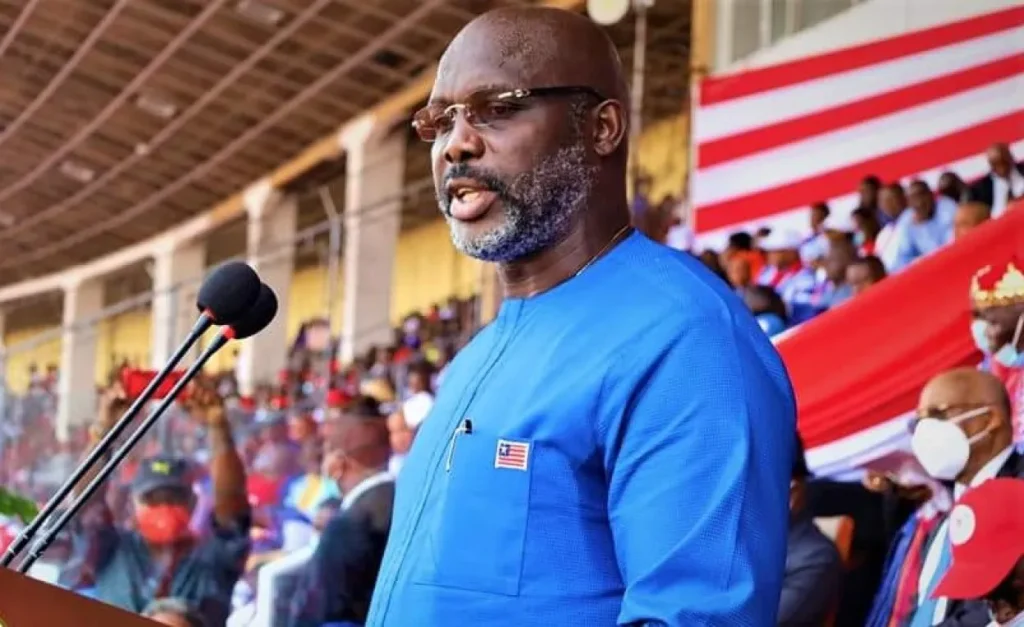

One of the most vocal critics of the reform is Borno State Governor Babagana Zulum, who, during a high-level meeting with officials from the Presidency, called for careful consideration of the bills. He urged policymakers to “put on their thinking caps” to create reforms that protect citizens’ interests while fostering economic growth. Zulum’s remarks echo concerns raised by other state governors about the potential for increased taxation to stifle economic activity.

Taiwo Oyedele, the Chair of the Presidential Tax Reform Committee, defended the reforms, stating they aim to create a fairer tax system that benefits all Nigerians. He explained that the proposed changes include measures to close tax loopholes, streamline collection processes, and expand the tax base to include the informal sector. Oyedele also noted that the committee is working to protect the interests of those opposing the reforms, highlighting the need for balance in addressing conflicting priorities.

Private sector leaders have expressed reservations about the timing and implementation of the reforms, warning that poorly executed changes could discourage investment. Representatives from key industries have called for additional dialogue to ensure that the reforms do not harm economic recovery efforts following the COVID-19 pandemic and global inflation pressures.

The Senate’s decision to suspend debate underscores the complexities involved in overhauling Nigeria’s tax system. As consultations with the Accountant-General of the Federation and other stakeholders continue, many Nigerians await clarity on how the reforms will impact their daily lives and the broader economy.