Oil Prices Surge as U.S. Strikes Yemen’s Houthis, Brent Hits $71

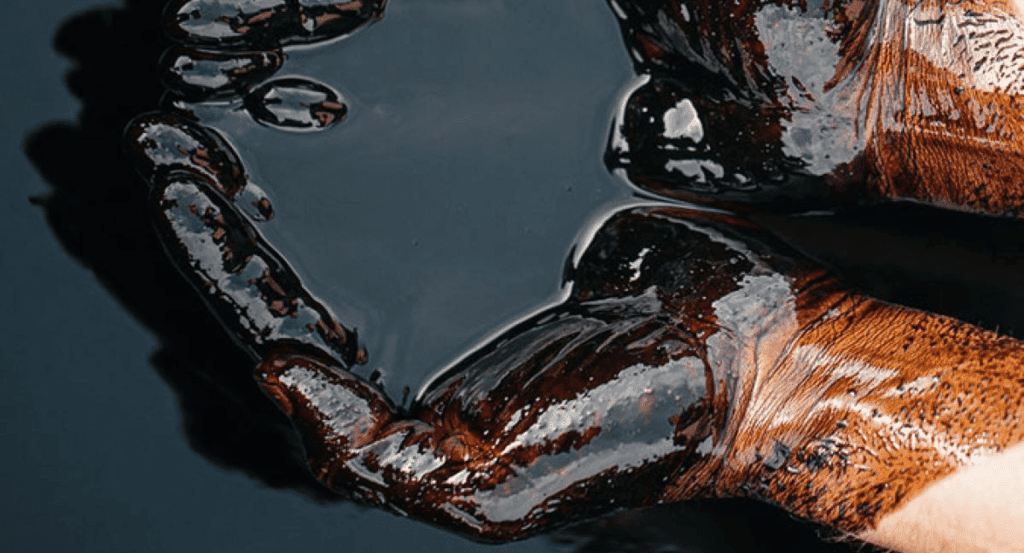

Brent oil futures climbed above $71 per barrel on Monday following a series of U.S. military strikes on Yemen’s Houthi rebels.

Key Market Drivers:

Geopolitical tensions in the Middle East

China’s positive economic data boosting demand outlook

Stronger oil market fundamentals despite global slowdown concerns

Impact of U.S. Strikes on Oil Prices

The U.S. has bombed Yemen for two consecutive nights, targeting Houthi leaders in response to attacks on American and commercial vessels in the Red Sea.

📌 Casualties in Yemen: At least 53 people, including children, have been killed, with over 100 others injured.

According to Reuters, the attacks ordered by President Donald Trump over the weekend have influenced a surge in crude oil prices:

- Brent crude: Up 76 cents (+1.1%) to $71.34 per barrel (as of 13:15 GMT).

- West Texas Intermediate (WTI) crude: Gained 65 cents (+1%) to $67.83 per barrel.

READ THIS: Trump Floods Truth Social with Over 100 Posts as Global Markets Plunge Amid Recession Fears

China’s Economy Bolsters Oil Demand

China’s retail sales growth accelerated in January-February, raising hopes of increased domestic consumption.

However, concerns remain as:

Factory output slowed

Unemployment rates increased

Despite mixed data, UBS analyst Giovanni Staunovo noted that oil prices are benefiting from:

- China’s potential stimulus measures

- Geopolitical risks in the Middle East

- Strong oil market fundamentals, including backwardation (where near-term oil contracts trade at a premium).

Oil Market Outlook: Pressure and Uncertainty

Despite the recent price increase, oil prices remain under pressure due to:

Brent crude down nearly 5% YTD amid global economic slowdown fears.

OPEC+ producers increasing output from April, potentially weighing on prices.

However, analysts suggest that tighter U.S. sanctions on Iran could offset rising OPEC+ production.

Another key market factor is the potential for a diplomatic breakthrough in Ukraine.

What This Means for Nigeria

Nigeria’s oil-dependent economy relies heavily on stable crude prices, and the government aims for oil to remain above $70 per barrel in 2025.

A drop in oil prices threatens national revenue, as crude exports drive Nigeria’s foreign earnings.

However, some experts warn that excessive oil price hikes could trigger inflation.

With rising geopolitical risks, global demand shifts, and OPEC+ production increases, Nigeria’s oil revenue outlook remains uncertain in 2025.