Ghana’s economy, which had been grappling with inflationary pressures, appears to be stabilizing as inflation drops for the second consecutive month.

According to Ghana’s statistics office, inflation decreased from 23.8% in December to 23.5% in January year-over-year—marking the first decline in inflation in five months. The trend continued in February, with inflation easing further to 23.1%, signaling a potential turnaround for the West African nation’s economy.

Factors Driving Inflation Decline

Government Statistician Samuel Kobina Annim revealed that prices rose by only 1.3% in February, indicating a slowdown in inflation. Several factors contributed to the easing price pressures:

- Declining fuel prices throughout the month

- Improved supply chains, reducing costs in key sectors

- A more stable cedi exchange rate, easing import costs

Economist Wilson Elorm Zilevu of Accra-based Databank Group attributed the inflation drop to these improvements, adding that food inflation fell to 28.1% from 28.3%, while non-food inflation declined to 18.8% from 19.2%.

Impact on Monetary Policy and Interest Rates

The Bank of Ghana may respond to the inflation drop by cutting interest rates for the first time since September, according to analysts. The current policy rate of 27% remains high compared to inflation levels, signaling room for monetary easing.

However, the central bank recently opted to maintain interest rates for a second consecutive month, as it continues efforts to control inflationary pressures. Experts suggest that Ghana’s new leadership is focused on tightening budgetary policies, which could further stabilize the economy.

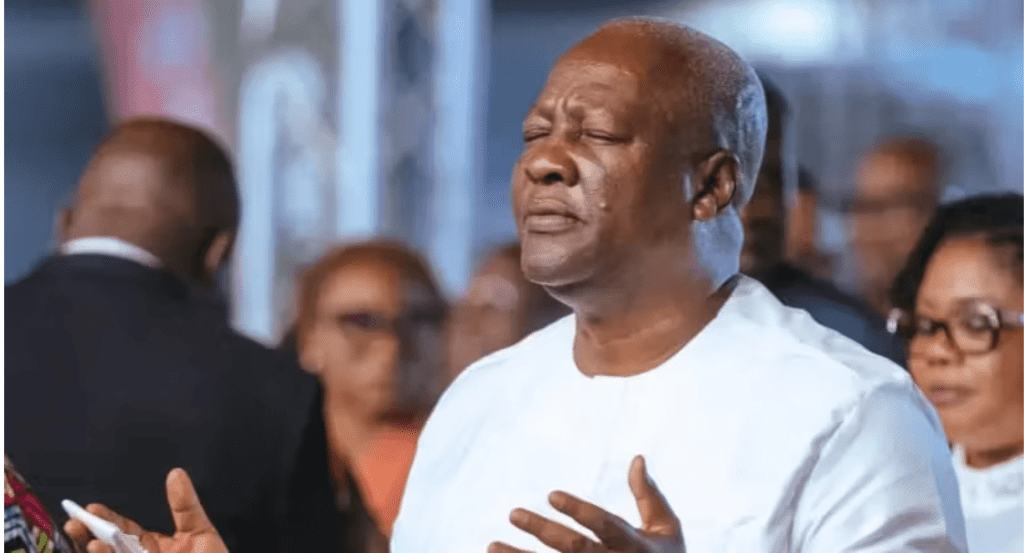

Economic Outlook Under Mahama’s Leadership

The inflation slowdown comes in the second month of John Mahama’s presidency, following his re-election in 2024. His administration faces the challenge of sustaining economic recovery, ensuring stable prices, and managing fiscal policies to support growth.

If inflation continues to decline, Ghana’s central bank may adjust its monetary stance, potentially easing borrowing costs and stimulating investment.