Nigeria launched a blockchain-based app, ‘Kora,’ designed to streamline interbank transactions across the country. Developed to enhance financial inclusion and efficiency, Kora leverages blockchain technology to enable real-time, secure transactions between banks and financial institutions. The app is part of a government-backed initiative to modernize the country’s financial infrastructure, making digital financial services more accessible for Nigerian citizens.

The launch event in Lagos was attended by financial industry leaders, government officials, and technology experts who highlighted the potential of blockchain to transform Nigeria’s banking sector. The ‘Kora’ app aims to simplify interbank transactions, reduce costs, and ensure secure payments, benefiting both consumers and businesses across the country.

Features and Benefits of Kora

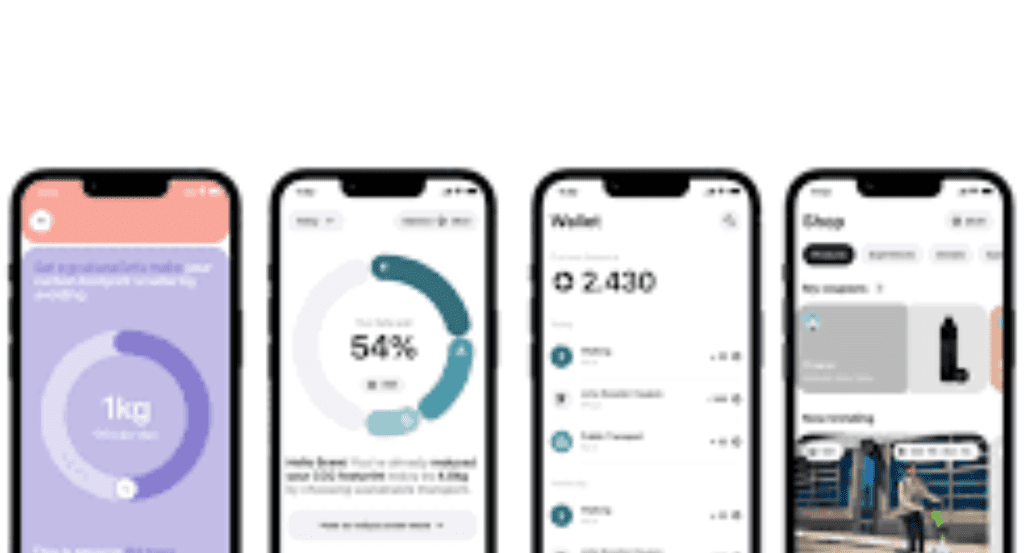

The Kora app operates on a decentralized blockchain platform, allowing users to send and receive funds seamlessly across different banks in Nigeria. By using blockchain, Kora provides enhanced transparency, security, and faster transaction times, eliminating the traditional delays associated with interbank transfers.

For businesses, Kora is expected to improve cash flow management by enabling instant payments. Individuals, particularly those in rural areas with limited access to banking services, will benefit from simplified transactions, as the app is accessible via mobile devices.

According to the Central Bank of Nigeria (CBN), the app’s integration of blockchain technology aligns with the government’s ongoing efforts to expand digital financial services and enhance trust in Nigeria’s banking system.

Security and Accessibility

Incorporating advanced encryption and blockchain protocols, Kora ensures that all transactions are protected against unauthorized access. The decentralized nature of blockchain enhances data security, reducing the risk of fraud and identity theft.

Kora is designed with user accessibility in mind, supporting multiple languages and offering a user-friendly interface to encourage adoption across all demographics. With smartphone penetration continuing to grow in Nigeria, officials are optimistic that Kora will reach a broad audience, particularly in regions with limited banking infrastructure.

Future Prospects

At the launch, Central Bank representatives indicated plans to expand Kora’s capabilities over time, potentially integrating the app with other African financial networks. By establishing a seamless interbank transaction system, Nigeria is positioning itself as a leader in digital banking within Africa.

As Kora gains traction, officials are optimistic that it will enhance Nigeria’s financial inclusion efforts, making banking services accessible to underserved communities while boosting confidence in digital financial platforms.