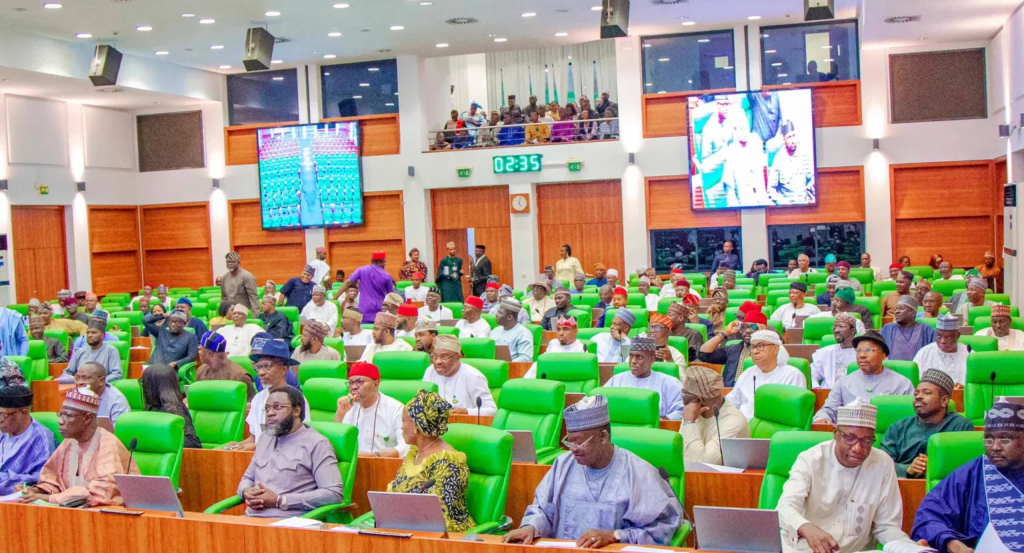

The Federal Government has commended lawmakers for the passage of four key tax reform bills for a second reading in the House of Representatives. The bills, aimed at overhauling Nigeria’s tax system, have sparked mixed reactions among legislators, with some expressing concerns over specific provisions.

The proposed reforms seek to streamline tax administration, expand the revenue base, and enhance compliance. Supporters argue that the bills will improve Nigeria’s fiscal structure, reduce tax evasion, and create a more business-friendly environment. However, some lawmakers have raised objections, citing potential implications for businesses and individual taxpayers.

Rep. Ahmed Jaha voiced concerns over certain provisions, warning that some measures could place an additional financial burden on Nigerians. He called for a careful review to ensure that the reforms do not stifle economic growth or disproportionately affect small and medium enterprises (SMEs). The debate reflects broader tensions surrounding tax policy in Nigeria, where the government seeks to increase revenue without worsening economic hardship.

Despite the disagreements, the bills successfully progressed to the next legislative stage, signaling lawmakers’ commitment to advancing tax reforms. The Federal Government has emphasized the importance of these bills in addressing revenue shortfalls and funding critical development projects. Officials have assured stakeholders that further consultations will be conducted to address concerns raised by lawmakers and the public.

As the legislative process continues, attention will be on the next phase of deliberations, where amendments may be made to balance revenue generation with economic sustainability. The outcome of these reforms is expected to shape Nigeria’s tax landscape and influence the business environment in the coming years.