The Socio-Economic Rights and Accountability Project (SERAP) has demanded that the Central Bank of Nigeria (CBN) reverse its recent increase in ATM withdrawal fees, calling the decision “unlawful and unfair.” The organization has given the apex bank 48 hours to withdraw the new charges, warning that failure to do so could lead to legal action.

SERAP argues that the increase in ATM transaction fees places an undue financial burden on Nigerians, particularly at a time when many are struggling with economic hardship. The group insists that the hike is not justified and violates citizens’ rights to economic justice. In an official statement, SERAP urged the CBN to prioritize the interests of consumers rather than imposing additional costs that could worsen financial exclusion.

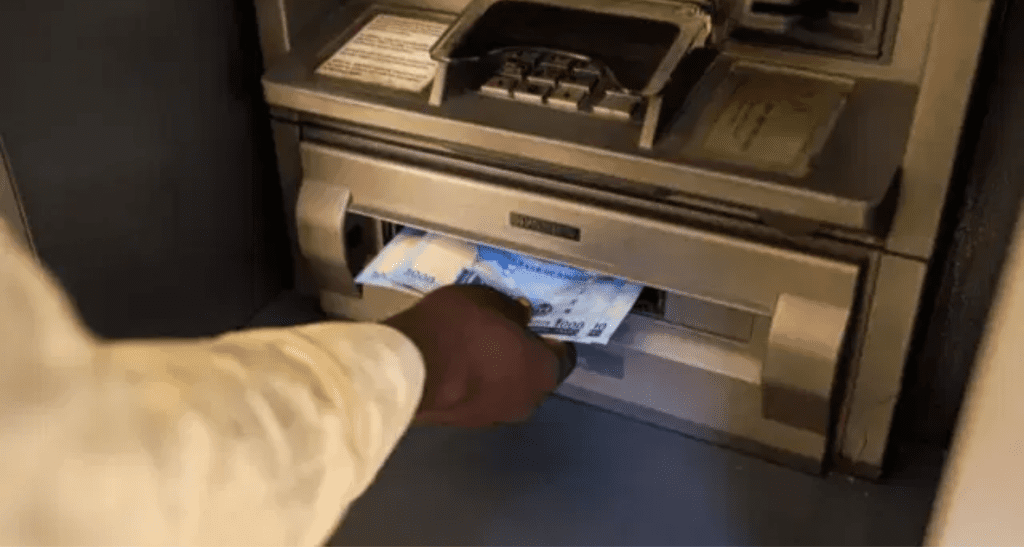

The new charges, announced by the CBN, have sparked widespread criticism from bank customers and advocacy groups. Under the revised structure, customers now pay higher fees for withdrawing cash from ATMs outside their bank’s network, in addition to increased costs for interbank transactions. Many Nigerians have taken to social media to express frustration, accusing the central bank of making banking services less accessible.

Consumer rights activists have also condemned the fee hike, stating that it contradicts the CBN’s financial inclusion goals. According to them, higher withdrawal charges could discourage cash transactions and push more people towards informal banking methods, undermining efforts to modernize Nigeria’s financial sector. Some financial analysts argue that while banks may justify the charges as necessary for operational costs, the decision lacks transparency and public consultation.

The CBN has yet to respond directly to SERAP’s demands but has previously defended the policy, stating that it aligns with global banking practices. The apex bank maintains that transaction fees are determined based on economic factors, including inflation and the cost of providing banking infrastructure. However, critics argue that Nigerian consumers are already burdened with multiple bank charges, and the latest increase only adds to their financial struggles.

SERAP has vowed to take legal action if the CBN does not reverse the decision within the given timeframe. The group also called on President Bola Tinubu’s administration to intervene and ensure that financial policies protect citizens rather than exploit them. The coming days will determine whether the central bank reconsiders its stance or faces a legal challenge from SERAP and other concerned groups.