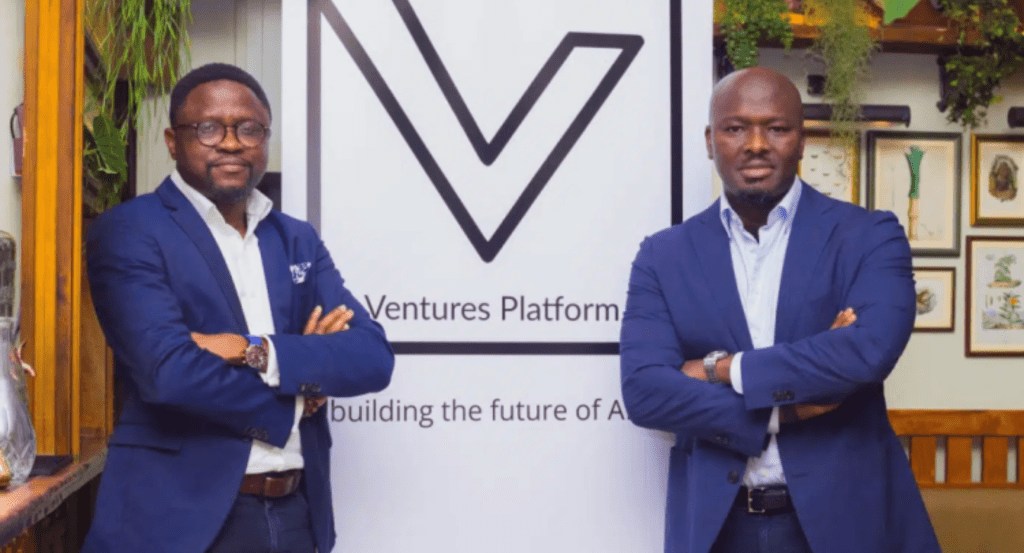

The International Finance Corporation (IFC) has committed $6 million in equity investment to the Ventures Platform Pan-African Fund II (VP II). This funding is aimed at boosting early-stage technology-enabled startups across Africa, enhancing access to seed-stage financing, and providing value-creation services for digital entrepreneurs. The fund will be managed by Ventures Platform GP Limited, a Nigeria-based firm led by experienced partners Kola Aina and Dotun Olowoporoku. While the fund will deploy capital across various African markets, Nigeria remains a key focus.

IFC’s Strategy to Develop Africa’s Digital Ecosystem

The investment aligns with IFC’s broader mission to strengthen Africa’s digital entrepreneurship ecosystem. Beyond financial backing, IFC seeks to stimulate local venture capital markets by setting an example for private investors, establishing enabling frameworks, and supporting capacity-building initiatives. Ventures Platform has emerged as a leading force in this effort, having successfully closed its first fund at $40 million in 2021, which later increased to $46 million in 2022 with additional support from institutional investors, commercial banks, and development finance institutions. Key backers of the fund include IFC, British International Investment (BII), Proparco, and AfricaGrow.

Ventures Platform’s Expanding Role in Africa’s Startup Scene

Founded in 2016 by Kola Aina, Ventures Platform has become a dominant player in Africa’s venture capital landscape. The firm has invested in over 90 startups, including high-profile names such as Piggyvest, PayHippo, Mono, SeamlessHR, Tizeti, and Printivo. The fund primarily focuses on pre-seed and seed-stage startups, with a growing allocation toward Series A rounds. It has also started providing follow-on capital to support portfolio companies as they scale beyond Series A. From its $46 million Fund I, Ventures Platform has deployed $19.6 million across various startups, with the majority going into pre-seed (51.49%) and seed-stage (40.84%) companies, while 7.64% has been directed towards pre-Series A ventures. The fintech sector has received the largest share of funding, totaling $6.8 million, followed by SaaS, health tech, and B2B startups.

Navigating a Challenging Venture Capital Landscape

Despite the slowdown in Africa’s venture capital funding, Ventures Platform remains optimistic about investment opportunities, particularly in intra-African remittances and businesses with strong unit economics. According to Kola Aina, the market downturn presents an ideal environment for strategic investments, as it filters out speculation and rewards businesses with strong fundamentals. Initially focused on Nigerian startups, Ventures Platform has recently expanded into South Africa, Zambia, and Egypt. The firm is also addressing the challenge of balancing the lifespan of its fund with the long-term capital needs of high-growth startups by increasing follow-on funding.

IFC’s Expanding Investment in African Venture Capital

The $6 million investment in Ventures Platform’s VP II is part of IFC’s broader strategy to foster the growth of African venture capital. IFC has been actively investing in early-stage VC funds to strengthen local capital markets and support African startups. Recent investments include a $6 million commitment to Flat6Labs’ new $85 million Africa Seed Fund, which supports early-stage companies. IFC has also invested $6 million in Lofty Alpha, a venture capital fund targeting early-stage tech startups as part of a $50 million round. In addition, it has allocated $5 million to Equator Africa Fund I, marking its entry into the climate tech venture capital space. IFC has also become a limited partner in P1 Ventures’ first institutional fund, which closed at $50 million, and Janngo Capital’s second fund, which raised €73 million ($78 million) to support diverse founders and underserved regions.

The Growing Importance of Local Venture Capital

As global capital markets tighten, IFC’s investments highlight the increasing role of local venture capital funds in bridging Africa’s startup funding gap. By backing Ventures Platform and other funds, IFC demonstrates its long-term commitment to fostering innovation, supporting high-potential startups, and strengthening Africa’s position in the global digital economy.