Nigeria’s oil revenue is set to decline as the Organization of the Petroleum Exporting Countries (OPEC) has decided to maintain its oil production cuts. The decision, aimed at stabilizing global oil prices amidst fluctuating demand, has directly impacted Nigeria, whose economy relies heavily on crude oil exports.

Nigeria’s oil revenue is set to decline as the Organization of the Petroleum Exporting Countries (OPEC) has decided to maintain its oil production cuts. The decision, aimed at stabilizing global oil prices amidst fluctuating demand, has directly impacted Nigeria, whose economy relies heavily on crude oil exports.

As part of the OPEC+ agreement, Nigeria has reduced its oil output to comply with the production cap. The cuts, which have been in place since 2020, are designed to curb oversupply and support oil prices following the collapse of global demand during the COVID-19 pandemic.

Impact on Nigeria’s Economy:

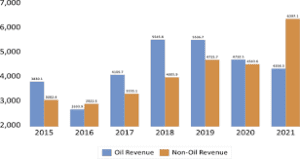

Revenue Decline: Oil exports account for over 90% of Nigeria’s foreign exchange earnings and about 60% of government revenue. The production cuts have led to a significant drop in these earnings, putting pressure on the nation’s fiscal position.

Budget Deficit: The federal government is likely to face a larger budget deficit as oil revenue projections fall short. In response, the government may need to explore alternative revenue sources or adjust its spending plans.

Currency Pressures: With lower oil revenue, the Nigerian naira has faced devaluation pressures, further impacting the country’s inflation rate and cost of living.

OPEC’s decision comes as global oil prices hover around $60 per barrel, a significant recovery from the lows of early 2020. However, analysts have noted that Nigeria’s ability to benefit from higher prices is constrained by the country’s reduced production levels under the OPEC+ agreement.

Government Response:

Nigeria’s Minister of State for Petroleum Resources, Timipre Sylva, acknowledged the challenges posed by the production cuts but expressed optimism that the global market will stabilize in the long run. “While the short-term impact on revenue is undeniable, these production cuts are necessary to ensure long-term price stability and market recovery,” he said during a press briefing.

Challenges and Outlook:

While the cuts have helped stabilize global oil prices, they have strained Nigeria’s already fragile economy, which is still recovering from the economic impact of the COVID-19 pandemic. The government is considering strategies to diversify the economy to reduce its dependence on oil revenue. In the meantime, the OPEC cuts are expected to continue for the foreseeable future, with regular reviews based on market conditions.

Oil Market Dynamics:

The decision by OPEC to extend production cuts highlights the ongoing volatility in the global oil market. As demand for oil gradually recovers, particularly with the global rollout of COVID-19 vaccines, Nigeria’s ability to ramp up production will be key to its economic rebound.