The Central Bank of Nigeria (CBN) has launched new digital initiatives aimed at simplifying payment processes and boosting efficiency in financial transactions across government ministries, departments, and agencies (MDAs). These tools, unveiled in Abuja on Tuesday, include DocFlow and the MDA Naira Payment Solution, both designed to enhance transparency, accountability, and service delivery in the public sector.

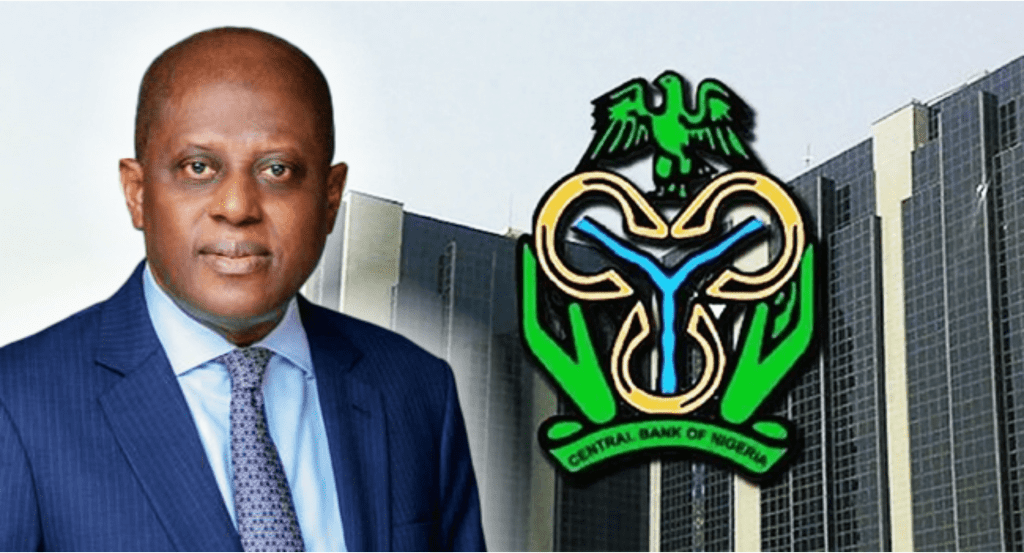

CBN Governor, Olayemi Cardoso, highlighted the significance of these innovations, stating that they are part of the bank’s ongoing efforts to modernize Nigeria’s financial ecosystem. He noted, “The digital tools will streamline payment processes, reduce bottlenecks, and enhance collaboration across MDAs, fostering a more efficient system.”

DocFlow:

One of the key features introduced is DocFlow, a document management system aimed at digitizing administrative processes. It provides a platform for electronic approvals, documentation, and workflow tracking, significantly reducing reliance on manual paperwork. This innovation is expected to enhance operational efficiency within government agencies while cutting down delays in critical decision-making processes.

MDA Naira Payment Solution:

Another highlight is the MDA Naira Payment Solution, a payment platform specifically designed for seamless financial transactions within government bodies. The tool allows for real-time tracking of payments, ensuring transparency and compliance with financial regulations. According to the CBN, this solution will also curb corruption by reducing the handling of cash and offering a clear audit trail for public funds.

The CBN’s move aligns with its broader objectives of promoting financial inclusion and leveraging digital solutions to build a cashless economy. Cardoso emphasized that the new systems are tailored to enhance accountability while improving public service delivery to citizens.

Experts in the financial sector have lauded these initiatives, stating that they mark a critical step toward digital transformation in government operations. The tools are expected to encourage private sector partnerships, promote innovation, and attract investment into Nigeria’s digital economy.

Public reactions have been largely positive, with many Nigerians optimistic about the potential impact on governance and transparency. However, some stakeholders have called for additional training programs to ensure that government employees can fully utilize the new technologies.

The CBN has assured stakeholders that adequate resources will be deployed for training and support, ensuring a smooth transition to these digital systems. As implementation begins, the central bank aims to set a new standard for efficient and transparent financial operations within the public sector.