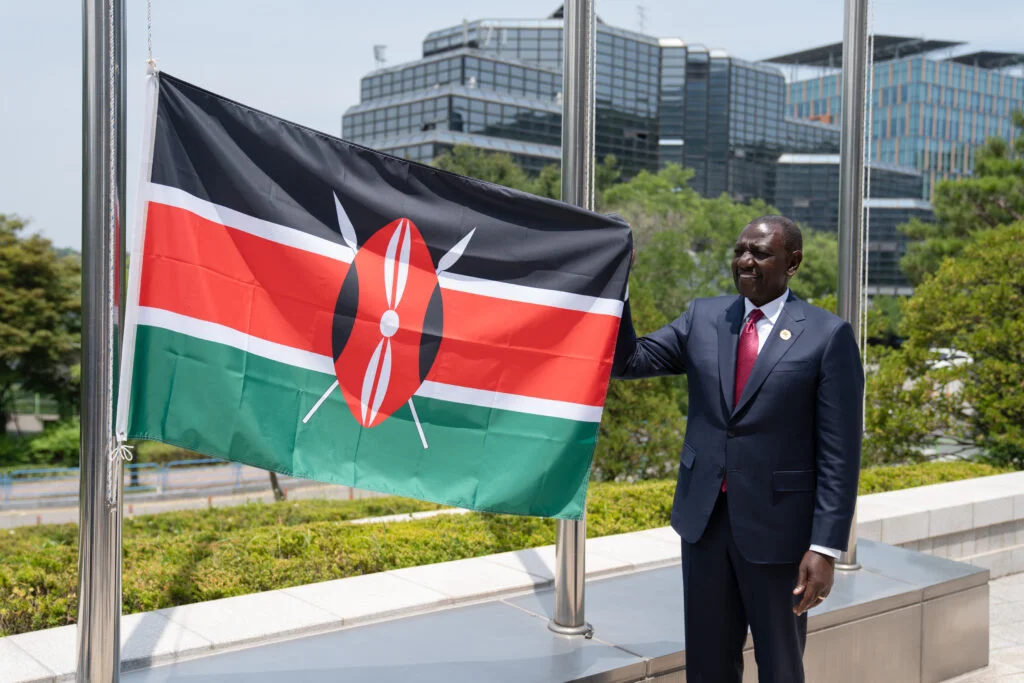

Africa’s financial landscape is thriving, and formal borrowing is on the rise! Recent data reveals the top African nations leading in formal borrowers those accessing loans from banks and regulated institutions.

Kenya shines at the forefront with 38 million, while Ghana and Uganda tie at 29 million each. Eswatini, Senegal, Namibia, Mauritius, Zambia, and Lesotho follow, showcasing a surge in financial inclusion. From Nairobi to Accra, citizens are tapping into credit, fueling dreams and growth.

This isn’t just about loans it’s about empowering Africa’s future.

Top Borrowers Breakdown

These nine nations are driving Africa’s credit revolution, with millions accessing formal loans:

- Kenya: 38 million borrowers, powered by mobile banking and fintech giants like M-Pesa.

- Ghana: 29 million, with vibrant banking hubs in Accra boosting access.

- Uganda: 29 million, leveraging microfinance to reach rural communities.

- Eswatini: 24 million, expanding credit through small business loans.

- Senegal: 23 million, with Dakar’s banks supporting youth and entrepreneurs.

- Namibia: 22 million, focusing on inclusive lending for growth.

- Mauritius: 19 million, a financial hub with strong credit systems.

- Zambia: 18 million, pushing agricultural and small-scale loans.

- Lesotho: 17 million, building credit access for rural development.

These numbers reflect a continent embracing financial systems to unlock potential.

Why Borrowing Matters

Formal borrowing signals trust in regulated institutions over informal lenders. In Kenya, mobile platforms like M-Pesa and KCB M-Pesa have revolutionized access, letting millions borrow instantly for businesses or education.

Ghana’s banking sector, with players like Standard Chartered, fuels urban and rural growth. Uganda’s microfinance networks empower farmers and small traders. Across these nations, credit is building businesses, homes, and futures, especially for youth and women.

This trend is reshaping Africa’s economic story, one loan at a time.

Economic Impact

The borrowing surge drives growth. In Kenya, 38 million borrowers translate to thriving small businesses and tech startups. Ghana’s 29 million support Accra’s bustling markets and real estate. Uganda’s loans boost agriculture, a lifeline for millions.

Eswatini and Senegal see rising entrepreneurship, while Namibia and Mauritius strengthen middle-class spending. Zambia and Lesotho’s credit access lifts rural economies, reducing poverty.

This financial wave could draw global investors, eyeing Africa’s dynamic markets.

Challenges and Opportunities

High borrowing brings risks debt defaults and over-leveraging loom. Kenya’s central bank warns of rising non-performing loans, urging smarter lending. Ghana faces similar concerns, with calls for better financial literacy.

Yet, opportunities abound. Digital banking, like Senegal’s mobile apps, cuts costs. Mauritius’ stable economy attracts foreign banks, while Lesotho’s rural focus bridges gaps. Governments must balance growth with oversight to keep the momentum.

Africa’s youth, eager for progress, are key to sustaining this boom.

A Bright Financial Future

These nine nations are rewriting Africa’s financial playbook. Kenya’s 38 million borrowers lead, but Ghana, Uganda, and others are close behind. From mobile loans to bank credit, Africans are seizing opportunities.

Will this spark a continent-wide economic leap? As Nigeria watches, inspired by its neighbors, the world sees Africa’s potential. The future is bright, and these borrowers are lighting the way.

READ ALSO: China Slams US, EU Sanctions on Russian Oil as Unlawful